![]()

|

|

|

As part of TBS efforts to improve reporting to Parliament, this website provides Parliamentarians with quick access to both financial and non-financial planning and performance information of individual departments and the Government of Canada as a whole.

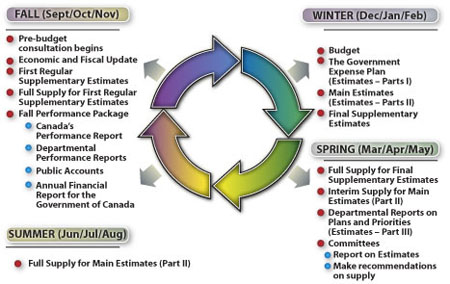

The Reporting Cycle illustrates the timing, events and reports related to the provision of financial and non-financial planning and performance information to parliament. The documents within the cycle support both the Government's efforts to effectively plan and evaluate its performance, and Parliament's budgetary, appropriation and accountability functions.

The Budget, which is typically tabled six weeks prior to the beginning of the fiscal year (April 1), identifies the broad spending priorities of the Government, and details how the Government plans to collect and invest taxpayers' money. The spending plans of the Government are outlined in greater detail within Parts I and II of the Estimates, which delineate the total voted and statutory expenditures of the Government and individual departments and agencies. Parliamentarians consider the information included in the Main Estimates when voting on the Budget and appropriations bills in Parliament. Parts I and II are supported by Part III of the Estimates, which is composed of two parts: Departmental Reports on Plans and Priorities (RPPs), and Departmental Performance Reports (DPRs). Canada's Performance report is tabled by the President of the Treasury Board, and is a chapeau piece to the DPRs that outlines how the Government of Canada contributes to Canada's performance as a nation. The Public Accounts of Canada is the annual report summarizing the financial transactions made by the Government of Canada during a given fiscal year ending at Mach 31. The Pre-budget consultation process begins in the fall with the tabling of the Economic and Fiscal Update, which provides an annual update on the national economic and federal fiscal situation leading to the budget-planning process. The fiscal projections in it form the basis for pre-budget policy discussions. The President of the Treasury Board tables Supplementary Estimates to obtain authority of Parliament to adjust the Government's expenditure plan, as reflected in the Estimates for that fiscal year.

Use the drop-down menu to view information relating to Canada's Performance for a particular year.

Click here to obtain the latest information relating to the Public Accounts.

The Public Accounts of Canada for previous years starting with 1995 are available in a PDF format from the Library and Archives Canada

| Winter -Budget -Estimates (Part I and II) -Supplementary Estimates |

Spring -RPP |

Summer -Supply |

Fall -DPR -Supplementary Estimates -Public Accounts -Canada's Performance |

The Budget outlines the government's fiscal, social and economic policies and priorities. It also includes the government's efforts to reconcile its spending obligations and revenue projections for the upcoming fiscal year. Typically, the Budget is presented in the second half of February, although the Government is under no obligation to do so.

The Estimates, along with the Budget and Economic and Fiscal Update, reflect the Government's annual budget planning and resource allocation priorities.

Each year, the Government prepares Estimates in support of its request to Parliament for authority to spend public funds. This request is formalized through the tabling of appropriation bills in Parliament. The Estimates, which are tabled in the House of Commons by the President of the Treasury Board, consist of three parts:

Part I - The Government Expense Plan provides an overview of federal spending and summarizes the relationship of the key elements of the Main Estimates to the current Expense Plan.

Part II - The Main Estimates directly support the Appropriation Act. The Main Estimates identify the spending authorities (Votes) and amounts to be included in subsequent appropriation bills. Parliament will be asked to approve these Votes to enable the government to proceed with its spending plans. Parts I and II of the Estimates are tabled concurrently on or before March 1.

Use the drop-down menu to view information relating to the Main Estimates for a particular year.

Part III is divided into two components:

Reports on Plans and Priorities (RPPs) are individual expenditure plans for each department and agency (excluding Crown Corporations) that elaborate on, and supplement, the information contained in the Main Estimates. They provide increased levels of details with regards to planned spending, on a strategic outcome and program activity basis, and describe planned priorities and expected results. The RPPs also provide details on human resource requirements, major capital projects, grants and contributions, and net program costs covering a three-year time horizon. These documents are normally tabled in the spring.

Use the drop-down menu to view information relating to Reports on Plans and Priorities for a particular year.

Departmental Performance Reports (DPRs) are individual department and agency accounts of results achieved against planned performance expectations, as set out in respective RPPs. The Departmental Performance Reports cover the most recently completed fiscal year and are normally tabled in the fall.

Use the drop-down menu to view information relating to Departmental Performance Reports for a particular year.

Note that the tabling of Departmental Performance Reports marks the end of the Reporting Cycle.

Since the Main Estimates are prepared well in advance of the beginning of a fiscal year, they do not always include the total expenses that are provided in the most recent Budget. For example, the Main Estimates would not include expenditures for initiatives announced in the Budget that require separate legislation or further development to implement.

Supplementary Estimates permit these requirements to be met within the overall planned expense levels provided for in the Budget or the Economic and Fiscal Update but not reflected in the Main Estimates.

Supplementary Estimates also provide an update on significant changes to expenditure forecasts of major statutory items. In addition, they are used to seek Parliamentary approval for such items as: transfers of money between votes; debt deletion; loan guarantees; new or increased grants; and changes to vote wording.

Normally there are two Supplementary Estimates documents published each year. Each document is identified sequentially by alphabet (A, B, C, etc.). The first normal or regular Supplementary Estimates document is tabled in late October and the final document in late February. Depending on timing requirements related to government spending priorities, an additional Supplementary Estimate may be tabled in the supply period ending in June.

Use the drop-down menu to view information relating to the Supplementary Estimates for a particular year.

Appropriation Acts for Main Estimates

When the Main Estimates are tabled in the House they are referred to various Standing Committees who must report back to the House (no later than May 31), on their review of the Estimates.

To provide for ongoing operations while the Main Estimates are under review the Treasury Board Secretariat prepares an Interim Supply Bill (generally referred to as Appropriation Act No. 1).

The Interim Supply Bill displays amounts of monies departments and agencies need to conduct their business over a three-month period.

The Bill is tabled and passed by the House of Commons and forwarded to the Senate. Once the Senate has dealt with the Bill, the House and the Senate will gather and a ceremony-like petition will be presented to the Crown to grant Royal Assent. Once Royal Assent is granted the Bill becomes law.

At the end of the three months the Treasury Board Secretariat prepares a Full Supply Bill which displays the remaining monies to be released.

The Bill is tabled and passed by the House of Commons and forwarded to the Senate. Once the Senate has dealt with the Bill, the House and the Senate present the Bill to the Crown to grant Royal Assent. Once Royal Assent is granted the Bill becomes law.

Appropriation Acts for Supplementary Estimates

All supply bills for Supplementary Estimates are full supply bills which means they are granted the full amount being asked for. The Treasury Board Secretariat will prepare a full supply bill following the tabling of each Supplementary Estimates publication.

Use the drop-down menu to view information relating to Appropriation Act for a particular year.

Canada's Performance is an annual report to Parliament on the federal government's contribution to Canada's performance as a nation - highlighting both strengths and areas for improvement. Canada's Performance provides a government-wide overview that enables spending and performance information to be presented in a comprehensible format, easily accessible to Parliamentarians and Canadians.

To provide a broad overview of the federal government's initiatives, commitments, and achievements in relation to long-term benefits for Canadians, past reports are structured around three key spending areas: Economic, Social and International Affairs. Canada's Performance is a companion piece for the Departmental Performance Reports and the electronic version helps parliamentarians and Canadians find the information they need in the individual performance reports. It also assists the reader in determining which strategic outcomes federal organizations work to achieve.

Use the drop-down menu to view information relating to Canada's Performance for a particular year.

The Public Accounts of Canada is the report of the Government of Canada prepared each fiscal year by the Receiver General.

The report covers the fiscal year of the Government, which ends on March 31, and is prepared from data contained in the accounts of Canada and from more detailed records maintained in departments and agencies. The accounts of Canada is the centralized record of the Government's financial transactions maintained by the Receiver General in which the transactions of all departments and agencies are summarized. Each department and agency is responsible for reconciling its accounts to the control accounts of the Receiver General, and for maintaining detailed records of the transactions in their accounts.

The Public Accounts of Canada is produced in three volumes:

Click here to obtain the latest information relating to the Public Accounts.

The Public Accounts of Canada for previous years starting with 1995 are available in a PDF format from the Library and Archives Canada

Dissolution of Parliament

Governor General Special Warrants (Special Warrants) are the established instrument for obtaining Supply when Parliament is dissolved for the purposes of a general election.

The Financial Administration Act requires the following conditions to be met before Special Warrants are issued:

Special Warrants cannot be used to increase or establish new grants, delete debts, or change limits on the issuance of loans or loan guarantees. Special Warrants cannot be used to create new organizations or programs that require new votes (spending authorities), transfer funds between votes, or to approve new revenue re-spending authorities or revolving funds.

Use the drop-down menu to view information relating to Governor General Special Warrants for a particular year.