|

|

-

Archived Departmental Publications

-

|

|

|

This Web page has been archived on the Web. This Web page has been archived on the Web.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats by contacting us.

PDF Version

PDF Version

Honourable Peter MacKay, P.C., M.P.

Minister of Justice and Attorney General of Canada

Table of Content

Chief Administrator’s Message

Section I: Organizational Overview

Section II: Analysis of Programs by Strategic Outcome

Section III: Supplementary Information

Section IV: Other Items of Interest

Endnotes

Chief Administrator’s Message

I am pleased to present the 2012-13 Departmental Performance Report for the Courts Administration Service (CAS). This report summarizes the organization’s progress and challenges in addressing the priorities set out in its 2012-13 Report on Plans and Priorities, and highlights how we continued to play a vital role in support of Canada’s justice system by providing essential services to the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada.

During the last year, CAS committed its efforts and resources to maintain services to the members of the courts and ensure timely and fair access to the litigation process of each court. We reinforced our governance structure, reallocated resources in direct support of judicial and registry services and implemented new electronic work tools.

However increasing pressures on our finances have limited significantly our ability to respond adequately to the challenges faced by the courts. To address this, we continue to explore viable long-term solutions.

I would like to extend my sincere thanks to CAS employees for their dedication, expertise and professionalism. Our employees are essential to CAS’ ability to fulfill its mandate and deliver services which support the courts, litigants and the public.

In closing, I wish to express my sincere gratitude to the Chief Justices and members of the four courts for their support, their patience and their collaboration over the past year.

Daniel Gosselin, FCPA, FCA,

Chief Administrator

Section I: Organizational Overview

Raison d'être

The Courts Administration Service (CAS) was established in 2003 with the coming into force of the Courts Administration Service Act. The role of CAS is to provide effective and efficient registry, judicial and corporate services to four superior courts of record – the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. CAS is further mandated by the Act to enhance judicial independence by placing the judiciary at arm’s length from the federal government while ensuring greater accountability for the use of public money.

Responsibilities

CAS recognizes the independence of the courts in the conduct of their own affairs and aims to provide each court with quality and efficient administrative and registry services. Pursuant to s. 2 of the Act, CAS is mandated to:

- Facilitate coordination and cooperation among the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court and the Tax Court of Canada for the purpose of ensuring the effective and efficient provision of administrative services;

- Enhance judicial independence by placing administrative services at arm’s length from the Government of Canada and by affirming the roles of chief justices and judges in the management of the courts; and

- Enhance accountability for the use of public money in support of court administration while safeguarding the independence of the judiciary.

In 2012-13, CAS had 612 employees in permanent offices in ten cities across Canada. The head office is located in Ottawa and its main regional offices are in Montréal, Toronto and Vancouver. Other offices are located in Halifax, Fredericton, Québec, Winnipeg, Calgary and Edmonton.

Judicial Independence

Judicial independence is a cornerstone of the Canadian judicial system. Under the Constitution, the judiciary is separate from, and independent of the executive and legislative branches of the Government of Canada. Judicial independence is a guarantee that judges will make decisions free of influence and based solely on facts and law. It has three components: security of tenure, financial security and administrative independence.

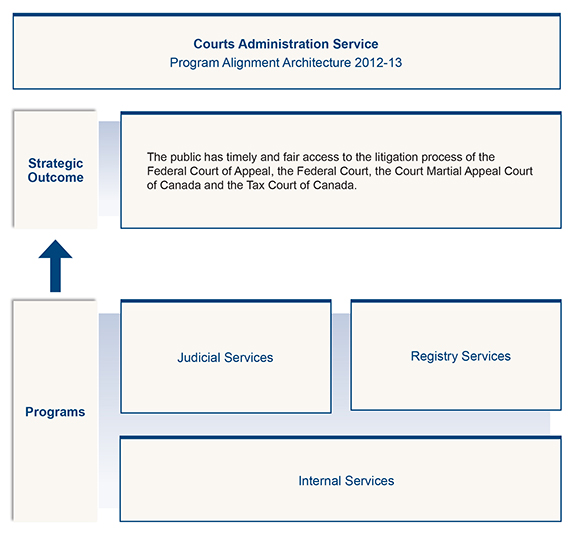

Strategic Outcome and Program Alignment Architecture

[text version] (opens in new window)

Organizational Priorities

| Priority |

Type |

Strategic Outcome |

| Maintain the capacity to deliver fully on our mandate. |

New |

The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. |

| Summary of Progress |

|

In 2012-13, CAS focused on maintaining its capacity to deliver on its mandate by prioritizing the allocation of its limited resources to meet the essential needs of the four courts and by taking action on various initiatives that improved core services and helped alleviate financial pressures.

The workload of the courts and the corresponding demand for CAS’ support services have increased significantly in recent years. Consequently, CAS allocated additional resources to the Judicial Services and the Registry Services programs to address their increasing workloads. Priority was given to the development of the Digital Audio Recording System (DARS), the On-line Law Clerk Application system, the Law Clerk Memo Retrieval system, and the maintenance of the E-filing Application system.

To strengthen its governance and to better support the distinct and specific needs of each court, CAS made important organizational changes in consultation with the CAS Chief Justices Steering Committee. The amalgamation of the Judicial Services and the Registry Services enhanced the level of administrative and legal support provided to members of the courts, and improved CAS’ management capacity and succession planning. |

| Priority |

Type |

Strategic Outcome |

| Enhance security measures and services provided to members of the courts, employees, litigants and the public. |

New |

The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. |

| Summary of Progress |

In 2012-13, CAS continued to work closely with representatives of the four courts through the CAS Chief Justices Steering Committee and the National Judges Committee on Security to enhance security and mitigate risks.

CAS initiated a comprehensive Threat and Risk Assessment (TRA) of the courts system to identify key improvements required to enhance security. The TRA results will assist the organization in confirming its priorities and in allocating its resources to security initiatives that address key risks and improve its security posture in facilities across Canada. The report will present benchmarks and findings on security programs, services and measures found in provincial, territorial and international jurisdictions. The TRA is also expected to highlight the required investment in security for the courts and provide the necessary basis for discussion with senior officials from other government departments about their roles and responsibilities in the management of courts’ security.

In 2012-13, contracts for external security expertise were put in place to provide for comprehensive national security services required for the installation and maintenance of CAS’ security systems and infrastructure. These contracts facilitate the standardization and enhancement of CAS’ monitoring and detection capabilities, they support the installation of better duress alarms and they improve monitoring and support systems.

Finally, CAS provided mandatory security training to employees, promoted security awareness in the workplace, conducted a review of its business continuity plans, and established a strategy to enhance existing processes and to ensure the continuation of critical services, when and where required. |

| Priority |

Type |

Strategic Outcome |

| Provide a robust, reliable and secure IM/IT infrastructure, and modernize judicial support systems. |

New |

The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. |

| Summary of Progress |

Many of the existing judicial systems used for managing court operations and handling court documents are obsolete, slow, unreliable and costly to maintain. In addition, the courts are still largely dependent on paper-based information, photocopying and physical delivery of documents. While efforts were made to move toward modernized courtrooms, digital court processes and electronic document management, funding restraints severely limited the resources available for strategic projects necessary to address critical risk areas and allow the organization to become more effective and efficient in its delivery of services to the courts and litigants. As such, CAS is not meeting the requirements of the courts and litigants.

In 2012-13 CAS developed an IM/IT Strategic Plan to address some of the key concerns, and ensure that all IM/IT investments added value to the organization, maximized business benefits and minimized risks. In addition, CAS made some upgrades to its IT infrastructure, which included a new data centre, computer systems and security systems. These upgrades improve the security and integrity of CAS network and business systems.

A Digital Audio Recording System (DARS) was implemented to record court proceedings, and significant upgrades to its videoconferencing platform were made, thereby improving the quality, efficiency, and accessibility of the services offered by CAS to the courts. CAS also started implementing a secure internet-based Electronic Filing System which allows a party or their legal representative to upload and file documents electronically with the Federal Court. An on-line application tool for the hiring of law clerks was launched to reduce the workload associated with the management of application forms and the interview process. In parallel, a law clerks memo retrieval system was implemented at the Federal Court of Appeal and at the Tax Court of Canada to enable judges, law clerks, and judicial assistants to access and retrieve key information more rapidly and efficiently.

To address its policy requirements for IM/IT and Information Management and Records Management (IM/RM), CAS is in the process of developing its IM/IT Policy Framework, IM/RM Framework and Implementation Plan, Recordkeeping Implementation Plan and Judicial Vision and Judicial Information Framework.

Finally, CAS adapted and strengthened its project management practices and continued to provide guidance and training to all employees and judges on its new electronic tools. |

| Priority |

Type |

Strategic Outcome |

| Ensure the long-term financial viability of the organization and establish a work environment that addresses employee needs. |

Previously committed to |

The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. |

| Summary of Progress |

Long-term Financial Viability

To maximize the use of its limited financial resources, CAS remained prudent and responsive in its business planning, budget exercises, and staffing actions. With the involvement of the CAS Chief Justices Steering Committee, the organization took major steps to review its strategic approach and priorities for the next five years, while also addressing corporate risks and other significant matters affecting the conduct of the courts. As a result, CAS reinforced its governance, risk management and investment planning, and enhanced its internal controls. These continuous efforts to strengthen the overall management framework ensure better organizational control and the most effective utilization of human and financial resources.

Meeting the needs of the members of the courts is always the principal driver for CAS. Accordingly, additional resources were allocated to address their increasing workload and to develop electronic systems in support of court business. In this regard, priority was given to the development of new electronic tools (E-filing application, DARS and the on-line law clerk application system) which are expected to generate savings.

CAS actively supported the greening of government operations through instituted practices which helped reduce paper consumption and increased sharing of IT equipment such as printers. In continued efforts to reduce government travel, CAS increased its use of videoconferencing, which helped reduce the organization’s environmental footprint.

An improved governance structure for investment planning helped CAS ensure that its investment decisions fully support the priorities of the organization and the needs of the courts. This is critically important in a time of limited resources and growing demands on its resource base. CAS’ first five-year Investment Plan (2012-13 through 2016-17) was approved in 2012-13 by the Secretary of the Treasury Board of Canada. In 2012-13, CAS applied its Project Management Framework to all of its investment projects. This framework is designed to ensure that projects make efficient use of available resources and address the specific needs of the organization.

Throughout the year, CAS successfully implemented the main requirements of the deficit reduction action plan in the Government of Canada’s Budget 2012. CAS also completed the implementation of its new data center.

In spite of these initiatives and efficiencies, CAS still needs additional funding to properly meet all of the requirements to fulfill its mandate. To address this issue, CAS prepared a business case identifying the level of program integrity funding required, and continued to work collaboratively with central agencies to develop a more sustainable, sound and stable funding model.

Employee Needs

In 2012-13, CAS provided employees with necessary training to perform their essential duties. Training on security, diversity and the new digital audio recording system was offered to employees, as well as information sessions on duty to accommodate. Subject matter experts were also identified within the organization to deliver training, learning circles and workshops on information management, classification and performance management. In addition, a mentoring program was launched in collaboration with Infrastructure Canada to allow employees to develop important leadership competencies.

CAS continued the development of its Talent Management Program which will be implemented in 2013-14. The main objectives are to identify leadership competencies in executive-equivalent employees within the organization and establish a plan for the collaborative development of the management talents of each of the selected candidates.

In light of the new Value and Ethics Code of Conduct for the Public Service, CAS led extensive consultations with employees in all regions and head office to develop an organizational Code of Conduct. This provided a great opportunity to communicate the new public service code to employees.

In an effort to update the CAS 2011-14 Public Service Employee Survey (PSES) Action Plan and address issues of concern to employees, CAS conducted a nationwide consultation. As a result, Directors General and Directors have been tasked to implement various elements of the plan, which is expected to be fully implemented in 2013-14. This approach places clear accountabilities on CAS’ management team. |

|

| Priority: |

Type |

Strategic Outcome: |

| Review CAS’ governance to better respond to the specific needs of each court. |

New |

The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. |

| Summary of Progress |

Supported by extensive consultations with the four Chief Justices, CAS implemented a new organizational structure in 2012-13. This important change amalgamated the Judicial Services Branch with the Registry Services Branch, and improved the organization’s ability to offer better and more coordinated services that are tailored to each court and their respective clientele. More specifically, this change streamlined the reporting structure within the new Judicial and Registry Services Branch and allowed for better services to the Chief Justices.

An improved governance structure for investment planning helped CAS ensure that its investment decisions fully supported the priorities of the organization and the needs of the courts. In 2012-13, CAS’ first five-year Investment Plan (2012-13 to 2016-17), was approved by the Secretary of the Treasury Board of Canada. The investment plan emphasizes the importance of security and technology renewal, elements which remain fundamental to the effective delivery of justice to Canadians by the four courts.

Finally, CAS continued to improve its overall management practices in the various areas measured by the Treasury Board Secretariat through the Management Accountability Framework. In 2012-13, CAS achieved strong results for governance and leadership for the following areas of management: Financial Management and Control; Risk Management; and People Management. |

Risk Analysis

In 2012-13, CAS continued to manage its risks in a complex and challenging environment. As in previous years, the nature of CAS’ business, its governance structure and distinct clientele, as well as the unique characteristics of the Canadian judicial system, continued to pose challenges and risks to the effective management of CAS’ priorities.

CAS implemented strong governance oversight and risk management practices through the formal identification of risks and the development of clear mitigation measures and controls. These practices contributed to the establishment of priorities, planning and resource allocation, policy development and program management. CAS developed its Corporate Risk Profile (CRP) for 2012-13 which identified the top four corporate risks. These risks, listed below, were driven by many factors, including government-wide priorities and the organization's limited resources. They were published in the CAS RPP 2012-13.

| Risks |

Risk Response Strategy |

Link to Program Alignment Architecture |

Link to Organizational Priorities |

Courts and Registry Information Technology (IT) Systems – There is a risk that the courts and registry information technology systems and infrastructure will be unable to meet the requirements of evolving technology and program activities. |

IT infrastructure upgrade.

Regional Performance – satellite regions bandwidth upgrade.

New data center to increase storage capacity and performance. |

Strategic Outcome – The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada.

Programs – Judicial Services and Registry Services. |

Maintain the capacity to deliver fully on our mandate.

Provide a robust, reliable and secure IM/IT infrastructure, and modernize judicial support systems.

Review CAS’ governance to better respond to the specific needs of each court. |

Financial Resources Sufficiency – There is a risk that sufficient financial resources will not be available to maintain core operations. |

More frequent reviews of expenditures, commitments and staffing action to rapidly identify surpluses and pressures and to reallocate funding to elevate pressures.

Maintain application for program integrity.

Initiate discussion with TB to identify appropriate mechanism to fund non-discretionary expenditures. |

Strategic Outcome – The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada.

Programs – Judicial Services and Registry Services. |

Maintain the capacity to deliver fully on our mandate.

Enhance security measures and services provided to members of the courts, employees, litigants and the public.

Provide a robust, reliable and secure IM/IT infrastructure, and modernize judicial support systems.

Ensure the long-term financial viability of the organization and establish a work environment that addresses employee needs. |

Security – There is a risk that security may be compromised. |

Develop a National Security Strategy.

Develop a Hearing Risk Management Process and a Court Security Officer Program.

Modernize physical security measures, equipments and systems.

Develop and implement security standards on the use of external facilities. |

Strategic Outcome – The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada.

Programs – Judicial Services and Registry Services |

Maintain the capacity to deliver fully on our mandate.

Enhance security measures and services provided to members of the courts, employees, litigants and the public. |

Information Management (IM) – There is a risk of loss of hard copy and digital records. |

Implement a document management system. |

Strategic Outcome – The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada.

Programs – Judicial Services and Registry Services |

Maintain the capacity to deliver fully on our mandate.

Provide a robust, reliable and secure IM/IT infrastructure, and modernize judicial support systems |

Courts and Registry Information Technology Systems

To address this risk, the mitigation strategy focused on keeping up with current technological advancements and on improving the performance of system applications and legacy systems used by the courts and the legal profession. This was necessary to ensure that existing legacy systems continued to operate, while carrying on with the modernization of CAS’ essential information technology security controls and infrastructure systems. In addition, the IT infrastructure enhancements enabled CAS to augment the overall security of its data centre server and facilitate future upgrades and improvements to internal controls.

In 2012-13, CAS developed processes, procedures, and training to improve the safeguards, backup, and proper handling of confidential information. The migration of documents from the legacy Document Management System to a modern and more stable platform was also started.

In addition, CAS continued to work on finalizing its recordkeeping roadmap to comply with the Treasury Board Directive on Recordkeeping. The roadmap will facilitate effective recordkeeping by enabling CAS to improve the way in which it creates, acquires, captures, manages, and protects the integrity of business information generated in the course of delivering its programs and services.

Financial Resource Sufficiency

In 2012-13, CAS endeavoured to maximize the use of its limited financial resources and remained prudent and responsive in its business planning and budget exercises as well as in its staffing approach. CAS also increased its focus on high priority initiatives to ensure that the organization remained well positioned to continue to deliver essential services to the four courts. The organization continued to closely monitor its expenses and address promptly any emerging financial risk. However, despite these efforts, CAS still requires additional funding to meet the evolving and essential needs of the courts and to fulfill its mandate. To address its program integrity issues, CAS will continue to work collaboratively with the central agencies.

Security

Several initiatives and programs were developed to mitigate security risks. The new National Security Strategy defined the long-term approach while short-term priorities were identified through a new five-year Security Business Plan. Other initiatives include the Hearing Risk Management Process, the Court Security Officer Program, the Court Screening Program, and the Court Duress Alarm.

In addition, a comprehensive Threat and Risk Assessment (TRA) was initiated in 2012-13. The results of the TRA will help confirm the priorities identified in the Security Business Plan and allow CAS to better allocate the resources required to mitigate its security risks and enhance the organization’s security posture of its facilities across Canada.

Information Management (IM)

To mitigate this risk and ensure proper alignment with current information management principles, practices, and standards, CAS must adopt and implement a document management system which will act as a central repository to store and manage information resources of business value. In 2012-13, CAS developed a recordkeeping directive implementation plan, which offers a complete coverage of records and file types and assists with the development of strategies for the long-term preservation of digital information assets. CAS also developed a project proposal and implementation plan for a new document management system which, when implemented, will enable CAS users in all locations to efficiently and reliably create, secure, find, access, use, share, and trust information in all formats throughout the records management lifecycle process.

To mitigate file identification problems, CAS created a filing classification system in compliance with the Treasury Board’s Directive on Recordkeeping. This system facilitates the creation, acquisition, capture, management, and protection of the integrity of CAS information resources of business value.

The newly developed Information Systems (IS) Framework establishes practices, methods and compliance standards for CAS to ensure that IM security objectives and controls are met. The IS Strategic Plan provides the roadmap to proactively ensure the security of operations with means to detect, prevent and respond in the event of cyber threats that could disrupt CAS’ critical digital infrastructure. The IS Framework and Strategic Plan will offer a baseline to improve information governance, protection, security and privacy practices.

Summary of Performance

Financial Resources – Total Departmental ($ millions)

Total Budgetary Expenditures

(Main Estimates)

2012-13 |

Planned Spending

2012-13 |

Total Authorities

(available for use) 2012-13 |

Actual Spending

(authorities used)

2012-13 |

Difference (Planned vs. Actual Spending) |

| 64.8 |

68.1 |

71.3 |

65.6 |

2.5 |

Human Resources (Full-Time Equivalents— FTEs)

Planned

2012-13 |

Actual

2012-13 |

Difference

2012-13 |

| 639 |

612 |

27 |

Performance Summary Table for Strategic Outcome and Programs ($ millions)

Strategic Outcome: The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada.

| Program |

Total Budgetary Expenditures (Main Estimates) 2012-13 |

Planned Spending |

Total Authorities (available for use) 2012-13 |

Actual Spending (authorities used) |

Alignment to Government

of Canada Outcomes |

| 2012-13 |

2013-14 |

2014-15 |

2012-13 |

2011-12 |

2010-11 |

| Judicial Services |

21.9 |

22.0 |

21.8 |

21.8 |

22.8 |

21.1 |

21.6 |

19.9 |

Strong and independent democratic institutions. |

| Registry Services |

25.2 |

25.5 |

25.5 |

25.6 |

27.2 |

25.4 |

29.1 |

25.8 |

Strong and independent democratic institutions. |

Strategic Outcome

Sub-Total |

47.1 |

47.5 |

47.3 |

47.4 |

50.0 |

46.5 |

50.7 |

45.7 |

|

|

Performance Summary Table for Internal Services ($ millions)

| Internal Services |

Total Budgetary Expenditures(Main Estimates) 2012-13 |

Planned Spending |

Total Authorities (available for use)

2012-13 |

Actual Spending (authorities used) |

| 2012-13 |

2013-14 |

2014-15 |

2012-13 |

2011-12 |

2010-11 |

| |

17.7 |

20.6 |

18.4 |

18.3 |

21.3 |

19.1 |

22.5 |

17.9 |

| Sub-Total |

17.7 |

20.6 |

18.4 |

18.3 |

21.3 |

19.1 |

22.5 |

17.9 |

Total Performance Summary Table ($ millions)

| Strategic Outcome and Internal Services |

Total Budgetary Expenditures

(Main Estimates) 2012-13 |

Planned Spending |

Total Authorities

(available for use)

2012-13 |

Actual Spending (authorities used) |

| 2012-13 |

2013-14 |

2014-15 |

2012-13 |

2011-12 |

2010-11 |

| |

64.8 |

68.1 |

65.7 |

65.7 |

71.3 |

65.6 |

73.2 |

63.6 |

| Total |

64.8 |

68.1 |

65.7 |

65.7 |

71.3 |

65.6 |

73.2 |

63.6 |

The $3.2M variance between 2012-13 planned spending and 2012-13 total authorities is primarily the result of $3.4M in renewed funding for changes to the Immigration and Refugee Protection Act,

Division 9 being received through Supplementary Estimates B. Furthermore, the actual funding received in relation to the operating budget carry-forward and paylist expenditures was $0.2M greater than the amounts estimated in the 2012-13 RPP. These increases were partly offset by $0.4M in savings identified as part of the Budget 2012 Spending Review.

The variance between 2012-13 total authorities and 2012-13 actual spending represents a lapse of $5.7M. Of this amount, $2.9M is related to funding set aside by Treasury Board, within CAS’ budget, to support the reform of Canada’s refugee determination system. CAS is not authorized to use these funds until a new judicial appointment is made; since there was no such appointment during the year, the unused funding became a forced lapse.

The remaining lapse of $2.8M was related to a combination of factors including lower than expected salary expenditures and a technical adjustment to the employee benefit plan. In addition, there was an overall reduction in spending activities in some areas of the organization as well as project-related delays in IT, Security and Facilities

Expenditure Profile

Departmental Spending Trend

Departmental Spending Trend

[text version] (opens in new window)

The variations in CAS’ spending patterns are attributable to factors which fall under the organization's responsibilities (e.g., timing of capital investment projects) and factors resulting from government-wide decisions (e.g., signing of new collective agreements and various government expenditure restraint measures).

The significant level of actual spending in 2011-12 is the result of severance liquidation payments to employees in relation to collective agreements signed in 2011 a major investment in information technology infrastructure to address rust-out issues, including the construction of a new data centre, and the provision in Budget 2011 for permanent program integrity funding for CAS to improve its security services and to fund legislatively mandated judicial appointments.

The increase in planned spending in 2013-14 is due in part to the expected completion of severance liquidation payments, and in part to the resumption of funding for collective agreement increases.

Funding for support of additional judicial appointments for refugee reform under Bill C-11 is included in the planned spending levels but is not available to CAS until these appointments are made. To date, no judicial appointment has been made, and as a result, no actual spending has been incurred.

Estimates by Vote

For information on the courts Administration Service’s organizational Votes and/or statutory expenditures, please see the Public Accounts of Canada 2013 (Volume II) (opens in new window). An electronic version of the Public Accounts 2013 is available on the Public Works and Government Services Canada website (opens in new window).

Section II: Analysis of Programs by Strategic Outcome

Strategic Outcome

The public has timely and fair access to the litigation processes of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada.

Programs

Program 1: Judicial Services

Program Description

The Judicial Services program provides legal services and judicial administrative support to assist members of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada in the discharge of their judicial functions. These services are provided by legal counsel, judicial administrators, law clerks, jurilinguists, judicial assistants, library personnel and court attendants, under the direction of the four Chief Justices.

Financial Resources - For Program Level ($ millions)

Total Budgetary Expenditures

(Main Estimates) 2012-13 |

Planned Spending

2012-13 |

Total Authorities

(available for use)

2012-13 |

Actual Spending (authorities used)

2012-13 |

Difference

2012-13 |

| 21.9 |

22.0 |

22.8 |

21.1 |

0.9 |

Human Resources (FTEs) - For Program Level

Planned

2012-13 |

Actual

2012-13 |

Difference

2012-13 |

| 191 |

183 |

8 |

Performance Results - For Program

| Expected Results |

Performance Indicators |

Targets |

Actual

Results |

| Judges have the support and resources they require to discharge their judicial functions. |

On a scale of 1 to 5, satisfaction rate of judges of at least 4 with the services they received. |

80% |

To protect the judicial independence of the courts, reporting of performance results are not published. However, CAS' management ensures rigorous monitoring. |

Performance Analysis and Lessons Learned

In 2012-13, the Judicial Services program continued to provide essential legal and administrative services that enabled members of the courts to hear and dispose of cases efficiently. To better support the needs of the four courts served by CAS, a new organizational structure was developed in close consultation with the four Chief Justices. As a result, the executive legal services for the four courts have been adapted to better address the distinct and specific needs of each court through Executive Directors and General Counsel, and Senior Legal Counsels.

Throughout the year, CAS continued to update and standardize its judicial service processes, training and reference materials to ensure that judicial assistants have access to the detailed procedures required to process decisions and other matters. Ongoing efforts were also made to ensure the sharing of best practices and the coordination of services with the regional offices and amongst groups within the organization, to improve the quality and consistency of the services provided to members of the courts.

In December 2012, CAS launched an online application tool for the hiring of law clerks at the Federal Court of Appeal and at the Federal Court. This resulted in significant savings by reducing printing and administrative costs. In parallel, a law clerks memo retrieval system was launched at the Federal Court of Appeal and at the Tax Court of Canada. This system enables judges, law clerks and judicial assistants to access and retrieve key information more rapidly and efficiently.

The Judicial Services program continued to provide support to the various court liaison committees with the Bar. These forums are used to review litigation practice and rules and to make recommendations for improvement. In addition, during the reporting period, Judicial Services assisted the Federal Court with a pilot project for the judicial review of applications dealing with First Nations governance disputes. The objective is to facilitate more expeditious, cost effective and satisfactory resolution of such disputes.

The Judicial Services Branch also provided legal and administrative support to the courts’ Rules Committees. Last year, the Executive Legal Officers of the Federal Court of Appeal and Federal Court assisted with the global review and amendments to the Federal Courts Rules. Since their introduction in 1998, the rules had never been revised in their entirety. The revisions were published in February 2013. Also, in 2012-2013, the Executive Legal Counsel of the Tax Court of Canada continued to provide legal and administrative support to the members of the Tax Court of Canada Rules Committee and assisted the Rules Committee with proposed amendments to different sets of rules that were published in Part I of the Canada Gazette in December 2012. Following the publication, comments were received, and the proposed amendments were sent to the Governor in Council for final approval.

Program 2: Registry Services

Program Description

Registry Services are delivered under the jurisdiction of the Federal Court of Appeal, the Federal Court, the Court Martial Appeal Court of Canada and the Tax Court of Canada. The registries process legal documents, provide information to litigants on court procedures, maintain court records, participate in court hearings, support and assist in the enforcement of court orders, and work closely with the Offices of the four Chief Justices to ensure that matters are heard and decisions are rendered in a timely manner. Registry Services are offered in every province and territory through a network of permanent offices and agreements with provincial and territorial partners.

Financial Resources - For Program Level ($ millions)

Total Budgetary Expenditures

(Main Estimates) 2012-13 |

Planned Spending

2012-13 |

Total Authorities

(available for use)

2012-13 |

Actual Spending (authorities used)

2012-13 |

Difference

2012-13 |

| 25.2 |

25.5 |

27.2 |

25.4 |

0.1 |

Human Resources (FTEs) - For Program Level

Planned

2012-13 |

Actual

2012-13 |

Difference

2012-13 |

| 297 |

281 |

16 |

Performance Results - For Program

| Expected Results |

Performance Indicators |

Targets |

Actual

Results |

| Court files are always accurate and complete. |

On a scale of 1 to 5, satisfaction rate of clients and judges of at least 4 with accuracy and completeness of court files. |

80% |

The target was met. |

|

Performance Analysis and Lessons Learned

The registries of the four courts process court documents, provide information to litigants, maintain court records, support the members of the courts before, during and after court hearings, and assist the courts and parties with the enforcement of court orders.

The following statistics give an indication of the workload managed by the Judicial and Registry Services employees in support of the operations of the four courts:

- 44,426 proceedings were instituted or filed with the four courts;

- 34,512 court judgments, orders and directions were processed;

- 6,688 files were prepared for hearings and heard in court (excludes matters settled or discontinued prior hearings)

- 5,032 days in court ; and

- 456,666 recorded entries were made.

Throughout the fiscal year, the registries of each court continued to focus on improving services and work tools for employees. In 2012-13, a stand-alone DARS was launched for the Federal Court and Tax Court of Canada and initial orientation training was delivered across the country. As the number of hearings utilizing the system increases, CAS is expected to generate some savings by reducing its use of contracted court reporter services. CAS also began the development of a business plan for the implementation of DARS at the Federal Court of Appeal.

In 2012-13, the Judicial and Registry Services Branch continued to streamline and document its numerous processes and a survey was conducted to obtain employee feedback. The results of the survey will be used to develop and update registry processes, as required.

As a result of the new organizational structure, CAS created the Integrated Services and Planning Division to oversee the delivery of key services to the four courts and the new Judicial and Registry Services Branch. This includes the following services - library, translation and revision, distribution, business systems, and planning. While the implementation of a new Court and Registry Management System (CRMS) remains a long-term objective for the registries of the four courts, resources were used to upgrade existing legacy systems to respond to the needs of the courts and increase efficiency for registry employees.

The registries must continue to adapt to the changing needs of the Courts, amendments to Court rules and notices to the registry and to the profession. Ongoing collaboration and communication amongst is essential to the effective and efficient management of registry projects.

Program 3: Internal Services

Program Description

Internal Services are groups of related activities and resources that are administered to support the needs of programs and other corporate obligations of the organization. These groups are Management and Oversight Services, Communications Services, Legal Services, Human Resources Management Services, Financial Management Services, Information Management Services, Information Technology Services, Real Property Services, Materiel Services, Acquisition Services, and Travel and Other Administrative Services. Internal Services include only the activities and resources that apply across the organization and not those provided specifically to a program.

Financial Resources – For Program Level ($ millions)

Total Budgetary Expenditures

(Main Estimates) 2012-13 |

Planned Spending

2012-13 |

Total Authorities

(available for use)

2012-13 |

Actual Spending (authorities used)

2012-13 |

Difference

2012-13 |

| 17.7 |

20.6 |

21.3 |

19.1 |

1.5 |

Human Resources (FTEs) – For Program Level

Planned

2012-13 |

Actual

2012-13 |

Difference

2012-13 |

| 151 |

148 |

3 |

Performance Analysis and Lessons Learned

In 2012-13, several security initiatives and programs were developed to position CAS to mitigate risks. CAS initiated a comprehensive Threat and Risk Assessment (TRA) of the courts' system to identify key improvements required to enhance security. The TRA results will assist the organization in confirming its priorities and in allocating the available resources to security initiatives that mitigate the risks and enhances its security posture in facilities across Canada. In addition a National Security Strategy was developed to provide the long-term strategic approach while a five-year business plan was established to define the short-term priorities.

CAS also developed and approved its new IM/IT plan with revised priorities and projects. The plan identified IM/IT as one of the organization’s key priorities and outlined important decisions on strategic investments taking into consideration CAS’ 2012-13 Corporate Risk Profile. Investments included major upgrades to the technological infrastructure and the completion of the data centre move. The move facilitated the deployment of various levels of physical and technological protection, mitigated a number of IT risks, improved regional connections, made possible various network management solutions, improved the overall stability and reliability of the network, permitted the integration of adequate backup technologies, enhanced server security measures and preserved the integrity of information resources of business Value (official records related to CAS’ critical functions and activities).

In response to the 2011-13 PSES, an action plan was developed in consultation with employees, CAS management and the unions. The plan addressed a number of employee concerns in the areas of communications, learning and development, values and ethics and CAS’ ongoing financial pressures. As part of the action plan, various development opportunities including organizational talent management program were made available to employees and the modernization of CAS’ key competencies profile was completed. The implementation of the action plan began in 2012-13 and the evaluation, monitoring and reporting back to employees is planned for 2013-14.

In an effort to continue to strengthen its project management capacity, CAS provided project management oversight and direction to project managers. In addition, the Enterprise Project Management Office (EPMO) developed a draft “Process Documentation Methodology” to improve the design and development processes of business solutions.

Section III: Supplementary Information

Financial Statements Highlights

Condensed Statement of Operations and Departmental Net Financial Position

Courts Administration Service

Condensed Statement of Operations and Departmental Net Financial Position&(Unaudited)

For the Year Ended March 31, 2013

($ thousands) |

| |

2012-13

Planned

Results |

2012-13

Actual |

2011-12

Actual |

$ Change (2012-13 Planned vs. Actual) |

$ Change (2012-13 Actual vs. 2011-12 Actual) |

| Total expenses |

96,940 |

93,402 |

97,194 |

3,538 |

(3,792) |

| Total revenues |

0 |

4 |

7 |

(4) |

(3) |

| Net cost of operations before government funding and transfers |

96,940 |

93,398 |

97,187 |

3,542 |

(3,789) |

| Departmental net financial position |

942 |

542 |

(608) |

400 |

1,150 |

Statement of Operations and Departmental Net Financial Position

Total expenses: CAS’ total expenses were $93,402 thousand in 2012-13 ($97,194 thousand in 2011-12). The largest components in the decrease of $3,792 thousand (4%) were decreases of $1,271 thousand in salaries and employee benefits and $1,084 thousand in accommodations.

- Salaries and employee benefits: Salary and employee benefit expenses were $52,289 thousand in 2012-13 ($53,560 thousand in 2011-12). The $1,271 thousand (2%) decrease compared to 2011-12 is primarily due to changes in the severance pay program that resulted in a peak in salaries and employee benefits in 2011-12. Over half of CAS’ total expenses consist of salaries and employee benefits.

- Operating: Operating expenses were $41,113 thousand in 2012-13 ($43,634 thousand in 2011-12). The $2,521 thousand (6%) decrease compared to 2011-12 is attributable to decreases of $1,084 thousand in accommodations, $674 thousand in professional and special services, $679 thousand in machinery and equipment and other minor variances totalling $84 thousand. The variances are primarily explained by the relocation of the corporate functions to the Federal Judicial Building in the National Capital Region and the construction of the new data centre.

Total revenues: CAS’ gross revenues were $5,611 thousand in 2012-13 ($4,395 thousand in 2011-12). Gross revenues consist largely of revenues earned on behalf of Government. Such revenues are non-respendable, meaning that they cannot be used by CAS and are deposited directly into the Consolidated Revenue Fund (CRF).

Revenues earned on behalf of Government were $5,607 thousand in 2012-13 ($4,388 thousand in 2011-12). One major source of such revenues is fines and filing fees collected pursuant to the legislation and rules governing the courts. Another major source of revenue earned on behalf of Government consists of the allocation to Human Resources and Skills Development Canada (HRSDC) for the costs associated with the administration of Employment Insurance (EI) cases in the courts. Other revenues are generated by charges for photocopies of court documents and other miscellaneous revenues.

Net revenues were $4 thousand in 2012-13 ($7 thousand in 2011-12). This item consists of a small amount of respendable revenue from the sale of Crown assets.

Departmental Net Financial Position: CAS’ departmental net financial position was $542 thousand in 2012-13 (compared to ($608) thousand in 2011-12). CAS’ departmental net financial position represents the net resources (financial and non-financial) that will be used to provide future services to the courts and thereby to benefit Canadians.

Condensed Statement of Financial Position

Courts Administration Service

Condensed Statement of Financial Position (Unaudited)

As at March 31, 2013

($ thousands) |

| |

2012-13 |

2011-12 |

$ Change |

| Total net liabilities |

15,115 |

16,946 |

(1,831) |

| Total net financial assets |

7,804 |

9,822 |

(2,018) |

| Departmental net debt |

7,311 |

7,124 |

187 |

| Total non-financial assets |

7,853 |

6,516 |

1,337 |

| Departmental net financial position |

542 |

(608) |

1,150 |

Statement of Financial Position

Total net liabilities: CAS’ total liabilities as at March 31, 2013 were $15,115 thousand ($16,946 thousand as at March 31, 2012).

- Accounts payable and accrued liabilities: The balance as at March 31, 2013 was $3,160 thousand ($4,900 thousand as at March 31, 2012). The decrease of $1,740 thousand is mainly due to decreases in accounts payable to external parties and other government departments and agencies.

- Vacation pay and compensatory leave: The balance as at March 31, 2013 was $2,047 thousand ($2,158 thousand as at March 31, 2012). The decrease is due to a slight increase in the utilization of vacation leave.

- Deposit accounts: The balance as at March 31, 2013 was $6,776 thousand ($6,529 thousand as at March 31, 2012). Because they reflect many separate decisions of the courts, deposits cannot be projected and the balance in the deposit accounts can vary significantly from year to year.

- Employee future benefits: The balance as at March 31, 2013 was $3,132 thousand ($3,359 thousand as at March 31, 2012). In 2011-12, significant changes were made to the employee severance pay program and these changes have resulted in a decrease in employee future benefits over the past two years.

Total net financial assets: The balance as at March 31, 2013 was $7,804 thousand ($9,822 thousand as at March 31, 2012). This amount represents gross financial assets less financial assets held on behalf of the Government.

- Gross financial assets: The balance as at March 31, 2013 was $9,882 thousand ($11,436 thousand as at March 31, 2012). This decrease of $1,554 thousand is mainly due to a decrease in the amount due from the CRF. This amount represents the net amount of cash that CAS is entitled to withdraw from the CRF without generating additional charges against its authorities.

- Financial assets held on behalf of Government: The balance as at March 31, 2013 was $2,078 thousand ($1,614 thousand as at March 31, 2012). These assets consist primarily of accounts receivable from another governmental organization.

Departmental Net Debt: CAS’ departmental net debt (total liabilities less total net financial assets) was $7,311 thousand as at March 31, 2013 ($7,124 thousand as at March 31, 2012). The net debt indicator provides a measure of the future authorities required to pay for past transactions and events.

Total non-financial assets: The balance as at March 31, 2013 was $7,853 thousand ($6,516 thousand as at March 31, 2012). Non-financial assets consist of the tangible capital assets that are essential for the successful delivery of services required by the courts. Computer hardware and software (including assets under construction) totalled 44% of non-financial assets in 2012-13, while leasehold improvements accounted for 53%.

Re-investment in capital assets is crucial for maintaining secure modern facilities, updating technological infrastructure and information systems, and maintaining a reliable fleet of vehicles. CAS had tangible capital asset acquisitions of $2,233 thousand in 2012-13 ($2,623 thousand in 2011-12). Of this amount, $471 thousand (21%) related to computer hardware, $529 thousand (24%) related to computer software and $1,216 thousand (54%) related to leasehold improvements.

|

Financial Highlights – Charts and Graphs

Assets by Type

[text version] (opens in new window)

Liabilities by Type

[text version] (opens in new window)

Expenses by Type

[text version] (opens in new window)

Revenues by Type

[text version] (opens in new window)

Financial Statements

The CAS financial statements (opens in new window) can be found at: http://cas-cdc-www02.cas-satj.gc.ca/portal/page/portal/CAS/DPR-RMR_eng/fs-ef-2012-2013_eng (opens in new window)

Supplementary Information Tables

All electronic supplementary information tables (opens in new window) listed in the 2012-13 Departmental Performance Report can be found on the Courts Administration Service’s website (opens in new window).

Section IV: Other Items of Interest

Organizational Contact Information

Further information on the strategic planning portion of this document can be obtained by contacting:

Robert Monet

Director, Corporate Secretariat

Courts Administration Service

Ottawa, Ontario

K1A 0H9

Robert.Monet@cas-satj.gc.ca

Additional Information

Further information on the financial portion of this document can be obtained by contacting:

Paul Waksberg

Director General, Finance and Contracting Services

Courts Administration Service

Ottawa, Ontario

K1A 0H9

Paul.Waksberg@cas-satj.gc.ca

Endnotes

Type is defined as follows: previously committed to—committed to in the first or second fiscal year prior to the subject year of the report; ongoing—committed to at least three fiscal years prior to the subject year of the report; and new—newly committed to in the reporting year of the RPP or DPR.

Type is defined as follows: previously committed to—committed to in the first or second fiscal year prior to the subject year of the report; ongoing—committed to at least three fiscal years prior to the subject year of the report; and new—newly committed to in the reporting year of the RPP or DPR.

Type is defined as follows: previously committed to—committed to in the first or second fiscal year prior to the subject year of the report; ongoing—committed to at least three fiscal years prior to the subject year of the report; and new—newly committed to in the reporting year of the RPP or DPR. report; and new—newly committed to in the reporting year of the RPP or DPR.

Type is defined as follows: previously committed to—committed to in the first or second fiscal year prior to the subject year of the report; ongoing—committed to at least three fiscal years prior to the subject year of the report; and new—newly committed to in the reporting year of the RPP or DPR.

Type is defined as follows: previously committed to—committed to in the first or second fiscal year prior to the subject year of the report; ongoing—committed to at least three fiscal years prior to the subject year of the report; and new—newly committed to in the reporting year of the RPP or DPR.

For the Tax Court of Canada, days in court is defined as the number of court sitting days scheduled. This represented 1,800 of the 5,032 days in court reported in 2012–13.

|

|

|

|