Archived - Harper Government Tables Notice of Ways and Means Motion to Implement Tax Cuts for Families

Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

March 24, 2015 – Ottawa, Ontario – Department of Finance

Finance Minister Joe Oliver today tabled in the House of Commons a Notice of Ways and Means Motion (NWMM) to implement the Harper Government’s latest tax cuts for hard-working families, which were announced by Prime Minister Stephen Harper on October 30, 2014.

Quick Facts

- The NWMM includes the new Family Tax Cut, increases to the Child Care Expense Deduction maximum dollar limits and the repeal of the Child Tax Credit.

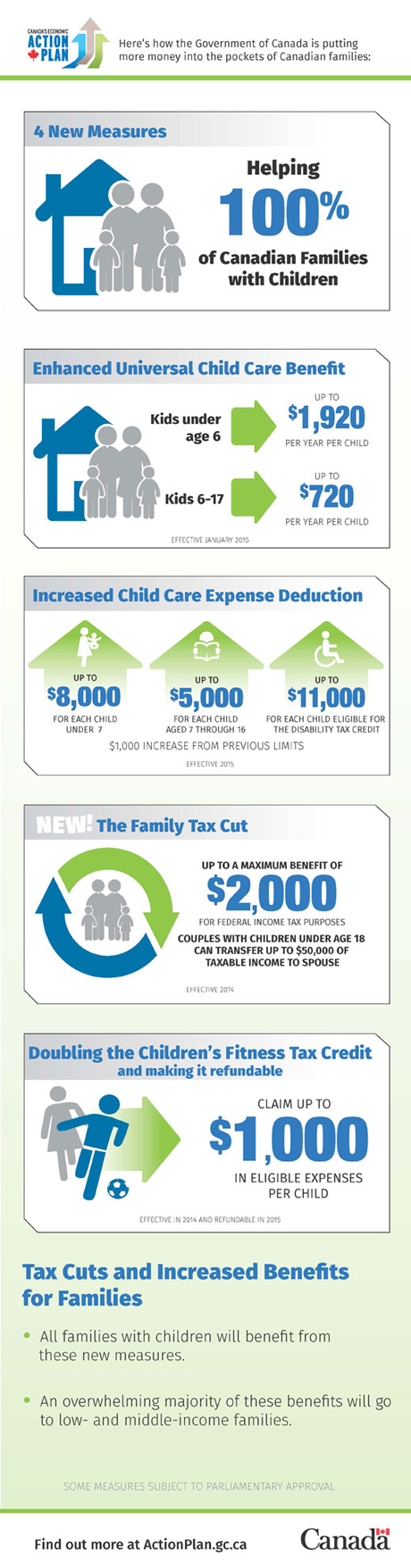

- The Family Tax Cut is a new tax credit aimed at couples with young children. It allows a spouse to effectively transfer up to $50,000 of taxable income to a spouse in a lower tax bracket, with a maximum tax saving of $2,000 for couples with children under the age of 18.

- The Child Care Expense Deduction dollar limits would increase by $1,000, effective as of the 2015 taxation year. The maximum amounts that can be claimed would increase to $8,000 from $7,000 for children under age 7, to $5,000 from $4,000 for children aged 7 through 16, and to $11,000 from $10,000 for children who are eligible for the Disability Tax Credit.

- The Child Tax Credit would be replaced with an enhanced Universal Child Care Benefit (UCCB) for the 2015 and subsequent taxation years. Proposed enhancements to the UCCB would increase the monthly benefit from $100 to $160 for each child under the age of 6. The UCCB would also be expanded—giving parents $60 per month for children aged 6 through 17.

- Taken together, the measures announced on October 30, 2014 will benefit every Canadian family with children—about 4 million families in total.

- Over 180 tax relief measures have been taken since the Harper Government took office in 2006. Together, with proposed enhancements to the UCCB, these measures will provide a typical two-earner family of four with up to $6,600 in savings in 2015 alone.

Quote

“Canadian parents work hard to make ends meet. We know what Canadians want: a government that empowers moms and dads, and does not tax away even more of their hard-earned income. They need a government that will put more money in their pockets so they can afford the best for their children. Our Government, under the leadership of Prime Minister Stephen Harper, is doing exactly that with our family benefits plan. Today, Canadians are paying less federal taxes than they did when John Diefenbaker was Prime Minister in the 1960s. This is the lowest federal tax burden in over half a century—an achievement that is creating jobs, growth, and long-term prosperity from coast to coast to coast.”

- Joe Oliver, Minister of Finance

Related Product

Additional Links

- PM announces tax cuts, increased benefits for families (October 30, 2014)

- My Benefits

Media Contacts

Melissa Lantsman

Director of Communications

Office of the Minister of Finance

613-369-5696

Stéphanie Rubec

Media Relations

Department of Finance

613-369-4000