Archived - Evaluation of the Retail Debt Program

Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Departmental Document

Final report prepared by KPMG ITnet

Approved by the Deputy Minister of Finance on the recommendation of the Audit and Evaluation Committee on May 26, 2015

Table of Contents

3.1 Question 1: Is there a continued need for the Retail Debt Program?

3.5 Question 5: To what extent are service levels and sales channels satisfactory to Canadians?

5.0 Strategic options and recommendations

Restrictions

This report has been prepared by KPMG LLP ("KPMG") on behalf of our subsidiary company, ITnet, for the Department of Finance of the Government of Canada ("Client") pursuant to the terms of ITnet's engagement agreement with Client dated July 12, 2013, (the "Engagement Agreement"). KPMG's findings and report are intended for internal use by the Client, the Treasury Board Secretariat, and the Bank of Canada.

KPMG and ITnet neither warrant nor represent that the information contained in this report is accurate, complete, sufficient or appropriate for use by any person or entity other than the Client, the Treasury Board Secretariat, or the Bank of Canada or for any purpose other than set out in the Engagement Agreement. This report may not be relied upon by any person or entity other than the Client, the Treasury Board Secretariat, or the Bank of Canada, and KPMG and ITnet hereby expressly disclaim any and all responsibility or liability to any person or entity other than Client, the Treasury Board Secretariat, or the Bank of Canada in connection with their use of this report.

Executive Summary

The Retail Debt Program was created in 1946 to provide Canadians with a secure Government of Canada retail savings instrument. The Retail Debt Program currently has two instruments, Canada Savings Bonds (CSBs) and Canada Premium Bonds (CPBs). CSBs are sold via payroll deduction and CPBs are sold via cash payment through financial institutions, investment dealers, and directly via telephone.

This evaluation of the Retail Debt Program was carried out as part of the Treasury Evaluation Program of the Department of Finance, with the participation of the Bank of Canada. The underlying goal of the evaluation was to assess the effectiveness of the Department of Finance and the Bank of Canada in enabling the Retail Debt Program to provide Canadians with access to Government of Canada retail savings instruments in a cost-effective manner. The evaluation examined the evolution, relevance, and performance of the Retail Debt Program.

The methodology for the evaluation included:

- A total of 26 sets of interviews -- ten with Department of Finance and Bank of Canada officials, and the rest with various external parties, including officials of Canadian banks, investment dealers, and the Retail Debt Program back office outsourcing contractor. These interviews also included seven employer-based campaign directors for the Canada Savings Bond program.

- An extensive analysis of over 300 documents and data sets.

- A comparative review of the retail debt programs of six other jurisdictions.

The evaluation found that, although the mandate and policies of the Retail Debt Program are consistent with federal government roles, responsibilities, and priorities, there is currently no valid economic rationale for the Retail Debt Program. It is no longer a net source of funds for the government, since it has been necessary since 1987 to borrow on the wholesale market to fund the net yearly redemptions. In addition, from the perspective of the Canadian public there is currently only a very limited need for the Retail Debt Program, because alternative retail debt instruments insured by the Canadian Deposit Insurance Corporation leave virtually no market void unaddressed.

Furthermore, the Retail Debt Program is not a cost-effective way for the Government to raise funds, and it is doubtful that it could return to cost effectiveness given the low interest rate environment combined with high and increasing administration cost per unit (i.e., due to retail debt stock declining faster than its administration costs).

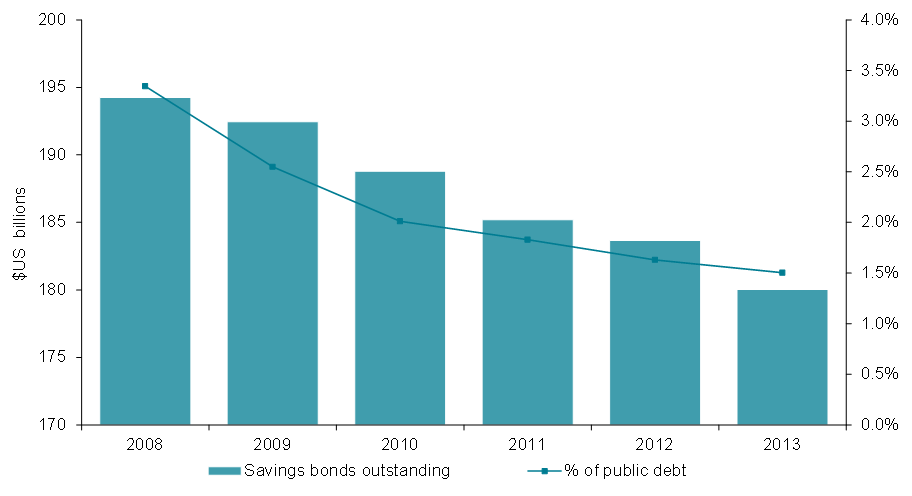

Canada's Retail Debt Program does not seem to compare favourably with the retail debt programs of other selected jurisdictions, even allowing for the fact that it is difficult to make apples to apples comparisons:

- The unit cost of Canada's Retail Debt Program operations is the highest amongst the jurisdictions investigated;

- Canada's retail debt outstanding as a share of national debt is the lowest amongst the jurisdictions investigated; and;

- Canada's retail debt outstanding per human resource involved in delivering the Retail Debt Program is the lowest amongst the jurisdictions investigated. However, further analysis would be required to understand the reasons behind this.

The overall findings regarding the Retail Debt Program business practices were positive. Service delivery methods: levels, marketing and advertising, management and operational procedures, and sales and redemption practices were found to be satisfactory.

The findings regarding the governance framework were also generally positive. The overall governance framework for the Retail Debt Program and the governance framework for the back office outsourcing contract were found to be aligned with leading practices and were clearly understood and accepted by all relevant parties. We did find, however, that there may be value in enhancing the level of consultations and information sharing between the Bank of Canada and the Department of Finance with regard to key decisions and outsourcing costs.

The primary recommendation of the evaluation study team is that the Retail Debt Program be wound down in an orderly fashion. Should the government, however, decide against a complete wind down of the Retail Debt Program based on analysis of its non-financial benefits and impacts, which were outside the scope of the current study, our fall-back recommendation would be to continue with a "no-frills version" of the Retail Debt Program. In this version the only channel maintained would be the cash sales channel. This option would allow the government to continue to provide Canadians with access to Government of Canada securities while further rationalizing the Retail Debt Program to save taxpayers money. Prerequisite activities for carrying out either of these two strategic options are outlined in the report.

Implementation of either of the two strategic options will have implications for the existing back-office outsourcing arrangement. We recommend that an independent outsourcing advisor be retained to assist in the evaluation of the strategic options put forward in this report and to assist in the development of a transition plan.

1.0 Introduction

1.1 Description of the Retail Debt Program

The Retail Debt Program (better known as the Canada Savings Bond Program) was created in 1946 to provide Canadians with a Government of Canada guaranteed savings instrument at a time when the retail savings market was underdeveloped and without Canadian Deposit Insurance Corporation (CDIC) insured instruments[1]. The Retail Debt Program currently has two instruments: Canada Savings Bonds (CSBs) and Canada Premium Bonds (CPBs). CSBs are sold via payroll deduction and CPBs are sold via cash payment through financial institutions, investment dealers, and directly via telephone.

There have been several changes to the Retail Debt Program since its inception:

- Following a significant decline in the total value of bonds outstanding, from nearly $55 billion in 1987 to about $30 billion in 1997, the government formed an agency, Canada Investment and Savings (CI&S), in 1997 with a mandate to revitalize the Retail Debt Program. However, the retail debt stock continued to decline, reaching about $15 billion by 2007 at which point CI&S was wound down and responsibilities for managing the Retail Debt Program were transferred back to the Bank of Canada and the Department of Finance.

- In 2001, the back office operations of the Retail Debt Program were outsourced to Electronic Data Systems to improve the efficiency of the management of operations. In 2008, Electronic Data Systems was acquired by Hewlett-Packard (HP), which assumed the Electronic Data Systems contract.

- In 2012-13, several changes were made to improve the efficiency of the Program and better align the product offerings to the needs of today's investors:

- The Program offered only one instrument per sales channel: CSBs available only via payroll channel, and CPBs sold only through the cash channel.

- CPBs were made redeemable throughout the year and the term to maturity of new CPBs was shortened from 10 to three years; and

- The term to maturity of new CSBs was shortened to three years.

- While a number of initiatives have been introduced over the years to improve the efficiency of the Retail Debt Program and better align the product offerings to the needs of investors, the stock of retail debt was less than $7.7 billion as of March 2013.

1.2 Study context and evaluation objectives

ITnet was engaged by the Department of Finance in June 2013 to undertake an evaluation of the Retail Debt Program. KPMG LLP, the parent company of ITnet, served as the delivery agent for this evaluation.

The Statement of Work for the evaluation describes its purpose as follows: The underlying goal of the evaluation is to assess the effectiveness of the Department of Finance and the Bank of Canada in enabling the Retail Debt Program to provide Canadians with access to Government of Canada retail savings instruments in a cost-effective manner. The objective [of the evaluation] is to evaluate the evolution, relevance, and performance (effectiveness, efficiency, and economy) of the Retail Debt Program.

The evaluation questions[2] identified in Evaluation Design Report (approved on July 29) were as follows:

Relevance

(1) Is there a continued need for the Retail Debt Program?

(2) To what extent are the current business practices and service delivery methods used in the Retail Debt Program still relevant – i.e., are they in or out of tune with today's market?

(3) To what extent are the Retail Debt Program mandate and policies consistent with federal government roles, responsibilities, and priorities?

Performance

(4) To what extent has the Retail Debt Program provided Canadians with access to retail savings products in a cost-effective manner?

(5) To what extent are service levels and sales channels satisfactory to Canadians?

(6) To what extent have marketing, advertising, and communications been effective in providing necessary information to potential buyers? Is 'awareness' the right objective?

(7) To what extent do the governance structure and accountabilities safeguard the interests of Canadians, as well as the interests of the federal government?

(8) To what extent do the management and operational systems and associated procedures (including the outsourcing of back office operations) effectively and efficiently support delivery of the Retail Debt Program?

(9) Are sale and redemption practices and processes effective and do they make sense?

(10) How do the resources used in the Retail Debt Program compare with the resources used by other jurisdictions?

The evaluation covers the timeframe from the wind down of CI&S in 2007 to the present, but the main focus of the evaluation was on the operation and performance of the Retail Debt Program over recent years.

2.0 Methodology

2.1 Data Collection Methods

Interviews

Five sets of interviews were held with Department of Finance officials, either in-person or by phone. These interviews dealt with program rationale, governance and management. One of these interviews also dealt with information regarding the retail debt programs of other countries.

Five sets of interviews were held with Bank of Canada officials, all in-person. These interviews dealt with program rationale, governance and management, and details of the delivery process. One of these interviews also related to client views of the Retail Debt Program.

Two sets of in-person group interviews were held with HP, including one "walk-through" of HP's operations.

Four interviews were held with senior officials of four major Canadian Banks by phone.

Seven telephone interviews were held with employer-based campaign directors for the payroll sales channel.

Two telephone interviews were held with investment dealers.

One telephone interview was held with the Banking Arrangements Directorate of Public Works and Government Services Canada (PWGSC).

Document and data review

This involved the analysis of available data and documents – including statistics and internal data analyses (inclusive of information regarding views of clients and potential clients), distribution and sales documents, governance and strategy documents, and documents related to management and operational systems. Over 300 documents and data sets were reviewed.

Comparative review

A comparative review was conducted of the retail debt programs of six other jurisdictions – four countries and two provinces. The following data collection activities were carried out:

- United Kingdom – Collection of background information followed by a telephone interview;

- Sweden – Collection of background information followed by completion of our interview guide by Swedish officials;

- Ontario – Collection of background information followed by a telephone interview;

- Quebec – Collection of background information followed by a telephone interview;

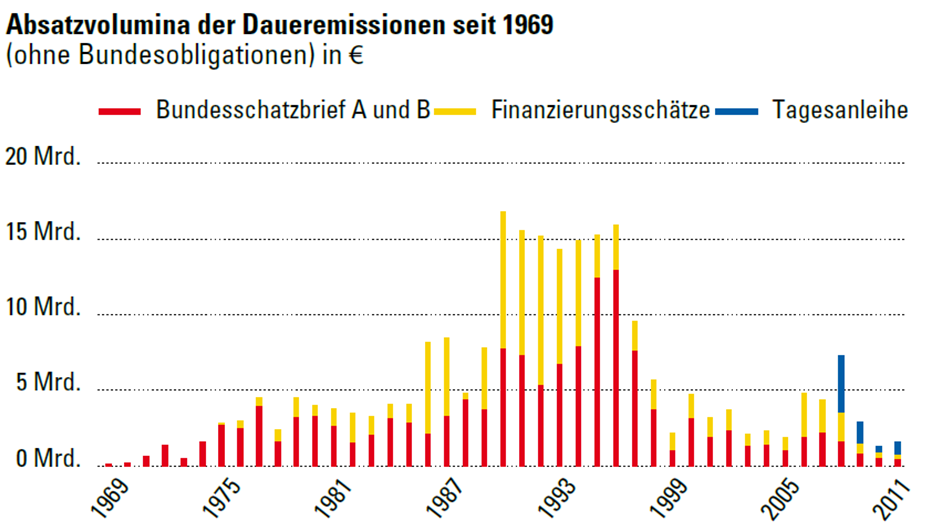

- Germany – Collection of background information; and

- United States – Collection of background information.

2.2 Limitations to the evaluation approach undertaken[3]

There are three limitations to the study methodology:

(1) The sample of employer-based campaign directors for the payroll sales channel whom we interviewed was a purposeful sample. We asked the Bank of Canada to identify people who had considerable experience with the payroll sales channel, so that they would be able to answer a broad range of interview questions, including questions about changes over time. It would be reasonable to expect that the answers of these people to some of our questions were not totally representative, for example, questions about the adequacy of support they receive from Bank of Canada (because very experienced people would not need much support).

(2) Another study limitation is that it was not within the scope of this study to carry out detailed analyses of the efficiency of certain specific aspects of the Retail Debt Program. These include sale and redemption operations and the Registered Product Program (analysis of the service delivery and fiduciary obligations associated with the administration of Canada Retirement Savings Plan and Canada Retirement Investment Fund plans). This was not part of the study design at the outset, as the intention was to focus the study resources on the most important evaluation questions, such as the overall performance and cost-effectiveness of the Program.

(3) One of the comparisons made between Canada's Retail Debt Program and the retail debt programs of the other jurisdictions that were willing to share this information was: the amount of retail debt outstanding per human resource involved in delivering the program. This comparison is relatively unfavourable to Canada's program, but it should be noted that it was beyond the scope of this study to conduct an in-depth analysis of the factors underlying this metric. Therefore, while this metric provides valuable indicative information, further study would be required to understand this metric better and know how it should be interpreted.

There are no other significant study limitations. The impacts of the above-mentioned limitations on study conclusions are expected to be minimal for the following reasons:

(1) In most cases the evaluation questions were addressed utilizing information collected through key informant interviews, complemented by document reviews and analysis of quantitative data regarding program operations and outcomes. This enabled proper triangulation of evidence to ensure that findings are based on the convergence of multiple data sources.

(2) In many cases, the same questions were asked of different groups of interviewees who would not be expected to necessarily have similar views based on their involvement in the Retail Debt Program. While the results of the different sets of interviews are presented in this report, findings and conclusions based largely on interviews are only presented in cases in which the interview data from different sources are convergent.

3.0 Evaluation Findings

This section presents the findings, analysis and supporting evidence to address the ten evaluation questions identified in section 1.2 Study context and evaluation objectives to assess the relevance and performance (efficiency, effectiveness and economy) of the Retail Debt Program.

3.1 Question 1: Is there a continued need for the Retail Debt Program?

To address this question, the following were considered:

- Evolution of the Retail Debt Program and the mix of sale and redemption activities. Statistics were sourced from documents supplied by the Department of Finance, the Bank of Canada and provincial comparators.

- Canada's Retail Debt Program market share in the universe of comparable savings instruments available to Canadians.

- The relevance of the Retail Debt Program as an alternative source of funds for the Government of Canada.

- Interviews with stakeholders to whom the question was directly asked.

- Net sales and outstanding stock of Retail Debt Program instruments.

Findings

- Outstanding stock is expected to reach a level where, despite all the recent accomplishments in cost reduction, it will be difficult to justify the existence of the Retail Debt Program either on economic grounds, on participation levels, or as a share of retail debt outstanding to market debt.

- The only segment still slightly growing is the payroll sales channel; however it is growing at a slow pace of $17 million for the 2012-2013 campaign and represents only 33% of outstanding retail debt.

- The proliferation of CDIC insured alternative retail savings instruments available from the private sector resulted in a dwindling market share of savings held in Canada's Retail Debt Program at a level estimated to be less than 1% as of March 2014.

- The main differentiating attribute of the Retail Debt Program remains the ease of purchase offered through the payroll sales channel. Other attributes such as rates, patriotic appeal, and government guarantee seem to be losing traction.

- As the overall sales of the Retail Debt Program do not exceed redemptions, the Retail Debt Program is not a source of funds for the government, as it has been necessary to borrow on the wholesale market to fund the net yearly redemptions.

Analysis and supporting evidence

Outstanding stock, sales and redemptions

The net sales of RDP products and outstanding debt are in steady decline since 1987.

Despite a number of initiatives introduced over the years to improve the efficiency of the Retail Debt Program and better align the product offerings to the needs of investors, the stock of retail debt declined to $7.7 billion or about 1% of the total composition of market debt (wholesale plus retail) as at March 31, 2013 (see Chart 1).

Retail Program - Sales and Debt Outstanding

billions of dollars

The stock of retail debt has declined by an average of $1.8 billion per year since 1987, which has made it necessary to borrow on the wholesale market to fund the net yearly redemptions. Over the three years 2010-11 through 2012-13 the annual rate of decline in the stock was between 11% and 13% (see Table 1).

| NET | 2010-11 | 2011-12 | 2012-13 |

|---|---|---|---|

| Financial Institutions/Banks/Direct | -1,208 | -1,015 | -1,162 |

| Investment Dealers | -423 | -179 | -224 |

| Payroll | 30 | 23 | 17 |

| Total | -1,601 | -1,171 | -1,369 |

| Decline as a % of outstanding stock | 13% | 11% | 15% |

To date the bulk of the outstanding stock has been sold through the cash sales channel (financial institutions, investment dealers, and direct).

- $5.1 billion notional outstanding out of $7.7 billion or 66% was sold through the cash sales channel; and

- $2.6 billion notional outstanding out of $7.7 billion or 33% was sold through the payroll sales channel.

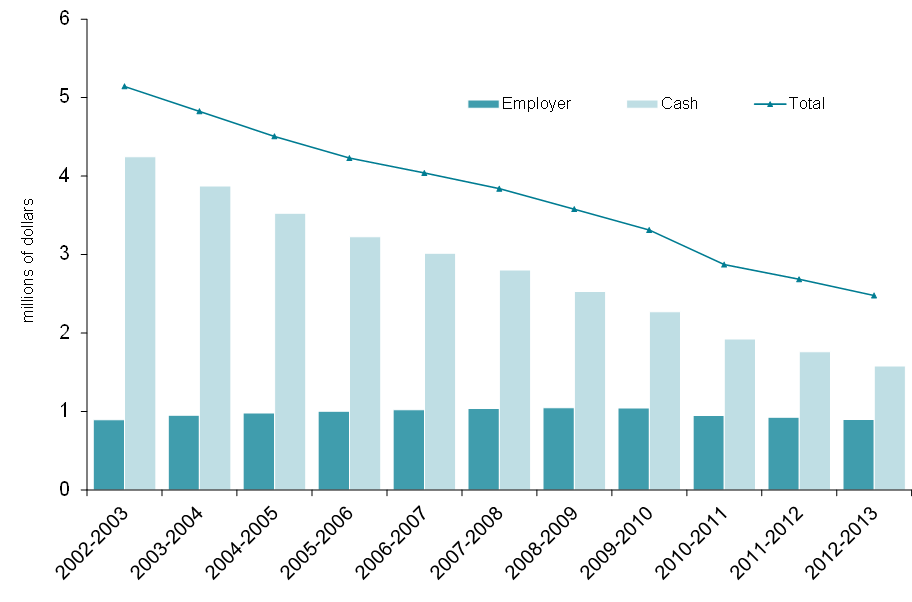

However, sales have gradually shifted predominantly to the payroll sales channel. Ten years ago, sales through the payroll sales channel amounted to $1.3 billion and represented 49% of total sales. They now represent 88% of total sales at $1.5 billion (see Chart 2).The only segment still growing marginally by net sales and outstanding stock is the payroll sales channel. Of note, total payroll savings bond redemptions are almost equal to payroll savings bond sales every year. About 95% of the total amount of bonds sold through the payroll channel yearly are redeemed each year, resulting in net sales of just $17 million in 2012-13. This indicates that owners of bonds sold through payroll deductions place value on the automated savings service, not the security itself.

Retail Debt Program Evolution of Sales, Redemptions and Outstanding Stock

If we extrapolate the current trend,

- The outstanding stock of retail debt instruments is projected to decline to $6.5 billion as at March 31, 2014 and expected to be under $4 billion as at March 31, 2022 (see Chart 2).

- If the trend in the rate of erosion of the outstanding stock originating from the cash channels and the slow positive growth added by the payroll channel continue, the stock attributable to the payroll channel should overtake that originating from cash channels within the next two to three years.

- The majority of the outstanding stock is in CSBs (64%) while CPBs account for (36%). We noted that the proportion of CSBs is growing. In the previous campaign (2011/2012), CSBs share accounted for 60%.

Number of accounts per sales channel

The number of Canadians holding CSBs and CPBs, using number of accounts as proxy, has been steadily declining. (See Chart 3). The median age of holders of CSBs and CPBs lines up with that of the general population, which is 41, according to the 2011 census.

Retail Debt Program Evolution of the Number of Accounts

The employer channel (payroll), with 898,000 accounts as at the end of April 2013 is declining at a slower pace than the cash channels, yet is losing an average of 37,000 accounts per year over the last three years. There were 1.58 million cash channel accounts at the end of April 2013, and the average yearly erosion over the last three years has been 238,000 accounts. In terms of geographical distribution, we observed that payroll sales channel sales are concentrated mostly in Ontario (48%) while Quebec accounts for 15%, BC for 9% and Alberta 6%;

Interviews

In our interviews with various stakeholders we asked about the continued need for the Retail Debt Program. We typically received the following answers:

- "As there are many substitutes, we do not see a need as may have been the case 20 years ago."

- "The payroll sales channel adds marginal value, but there would not be any gap in the universe of savings instruments available to Canadians should the Retail Debt Program disappear"

Comments from investment dealers and financial institutions received during Fall 2013 market consultations carried out by the Department of Finance and Bank of Canada[4], indicate that there is little interest on the part of the general public for direct access to Government of Canada wholesale debt, given the low yields and minor differences in safety with CDIC insured alternative retail savings instruments. Furthermore, according to these consultations, less than 2% of retail assets are directly held in Government of Canada (marketable) securities.

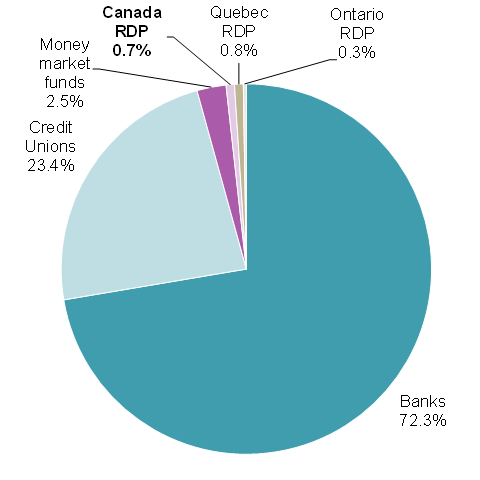

Overview of Canada's RDP positioning and market share

There is a proliferation of CDIC insured alternative retail savings instruments offered by financial institutions and provincial governments all competing for the finite savings of the Canadian population (see Table 2 and Chart 4).

Market Share of Retail Savings in Canada, 2013

| Borrower/savings vehicle | Amount outstanding ($ billion) |

% | Source |

|---|---|---|---|

| Canadian Chartered Banks (Personal demand and term savings deposits) | 768 | 72.3% | Table C41 |

| Credit Unions (Personal demand and term savings deposits) | 248 | 23.4% | Table D21 |

| Money market Funds2 | 27 | 2.5% | Table E11 |

| Ontario Retail Debt Program | 2.8 | 0.3% | OFA website |

| Quebec Retail Debt Program | 8.1 | 0.8% | Interview+ Web |

| Canada Retail Debt Program (April 2013) | 7.7 | 0.7% | BOC FY Summary |

| Total | 1,062 | ||

| 1 Bank of Canada Banking and Financial Statistics. (August 2013 bulletin) Amounts as of June 30th 2013 2 Does not include money market Exchange Traded Funds as we did not find a granular enough breakdown - Total government fixed income ETF's outstanding as of September 30,2013 amount to $ 3.2 billion (Source: Canadian ETF Association), but this includes not only comparable money market maturities, but also longer term securities as well as possibly foreign currency bonds. |

|||

The Retail Debt Program product differentiators are few and seem to have little impact. The Retail Debt Program's unique selling proposition that is not matched by the private sector is the ease of savings through payroll deduction. However, many FI's increasingly offer "automatic" savings features by automatic transfer from chequing accounts to high yield savings accounts, whereas this feature used to be limited to a few Schedule II banks.

With respect to the cash sales channel, based on our interviews of financial institutions and investment dealers, the most important differentiator is the interest rate, which is seen to have been non-competitive for the past few years (i.e., financial institutions and investment dealers do not view the Retail Debt Program as a competitive threat). It is important to note that this may indeed be only a perception resulting from the recent years of low interest rates.

The share of the Retail Debt Program in the planned Government of Canada sources and uses of borrowing for 2013-2014 is as follows:

- $2 billion out of a total of $242 billion cash raised through borrowing activities, or 0.8%.

- $3 billion out of total refinancing needs of $259 billion, or 1.16%.

We thus conclude that the Retail Debt Program does not contribute to the availability or diversification of Canada's funding.

3.2 Question 2: To what extent are the current business practices and service delivery methods used in the Retail Debt Program still relevant – i.e., are they in or out of tune with today's market?

To address this question, the following were considered:

- The perceptions, opinions and experience of CSB and CPB stakeholders:

- Employer organizations that provide the CSB payroll offering to their employees (via interviews conducted with a sample of employer-based campaign directors).

- Buyers of CSBs and CPBs (via available survey data).

- Financial institutions and investment dealers who sell and redeem CPBs (via interviews conducted with a sample of financial institution and investment dealer executives).

- A high-level review of the current back-office operations (via interviews and a site walk-through with back-office representatives).

- A comparison of Retail Debt Program business practices, processes and service delivery methods to those of other jurisdictions included within the scope of this evaluation.

- The business practices and service delivery methods associated with other comparable instruments/alternatives.

Findings

- Current business practices and service delivery methods are relevant and consistent with practices and delivery methods used in today's market.

- CSB delivery practices (i.e., via the payroll sales channel) require minimal administration on the part of employer organizations.

- Web-based self-service of the payroll sales channel provides CSB buyers with a high degree of convenience and flexibility.

- Financial institutions and investment dealers find current delivery practices for CPBs simple and straightforward.

- Back office practices and processes are effective and provide satisfactory support to both customers and those involved in the sales of CSBs and CPBs.

- Compared with other jurisdictions, the number of personnel involved in back office operations is high. However, reasons behind this high number were not analyzed.

Analysis and supporting evidence

Perceptions of interviewed employer-based campaign directors - payroll sales channel

The payroll sales channel is an easy way for people to save. It offers a seamless approach to savings through automatic payroll deduction. Web-based self-service provides participants with a high degree of convenience and flexibility in the management of their CSB accounts – e.g., participants have quick and easy access to funds and are able to increase, decrease and/or withdraw funds from their CSB accounts at any time without penalty.

The degree of efficiency and effectiveness of the practices and processes of the payroll sales channel is high with minimal administration, effort and responsibility on the part of participating employer organizations.

The re-introduction of paper-based CSB application forms (as an alternative to web-based forms) for the 2013 campaign has been of benefit to those who are not computer literate or don't have access to computers.

Perceptions of buyers - payroll sales channel

October and November 2012 CSB client satisfaction surveys suggested the following:

- Ease of access via payroll deduction was appreciated and deemed to be of value;

- The process is seen as user-friendly;

- Access is easy via on-line application and account maintenance; and

- Customer service is strong. However, there were some complaints about password set-up and reset and the system log-on process, the redemption process (including the length of time from redemption to automatic deposit, which is 3 days), and various technical issues.

A January 2010 Ipsos Reid survey cited the following:

- 90% of CSB holders who responded to the survey cited CSBs as easy to buy as compared to 79% of the CPB holders who responded to the survey;

- 91% of CSB holders who responded to the survey cited CSBs as easy to redeem as compared to 71% of the CPB holders who responded to the survey.

Perceptions of interviewed financial institutions and investment dealers – cash sales channel

Relevant financial institution interview responses were:

- Front-line sales and redemption processes are simple and straightforward with sufficient information being made available to the financial institutions to support them in fulfillment of their role and responsibilities.

- One financial institution offers their customers a fully automated process, whereas the three others interviewed have a paper-based process.

- There is recognition that a great deal of time and effort has been invested to streamline the back-office which has provided benefit to the financial institutions. A shorter campaign timeframe has also been raised as beneficial to financial institutions.

- The back-office practices and processes to support sales, redemption, and settlement are efficient, effective, user-friendly, and according to one interviewed financial institution "the best on the street".

Relevant investment dealer interview responses were:

- They are happy with the service level and support.

- They see the cashability of CPBs as a plus; however; the consensus was that they do not actively recommend CPBs to their clients due to the perception of non-competitive rates.

- Back-office was cited as being highly responsive.

Both investment dealers and financial institutions said that, to the best of their knowledge there have been no reported complaints from customers concerning the current business practices, processes, or service delivery methods. However, both groups also commented on the low commissions.

Back-office interviews and walk-through – payroll and cash sales channels

The back-office operation is managed and delivered by a team of roughly 220 human resources: 200 HP and 20 Bank of Canada. Our review of comparable programs in other jurisdictions indicated that this number is high. Based on a Full-Time-Equivalent (FTE) headcount of 220, the ratio of debt outstanding per FTE is about $35 million, whereas the range for other jurisdictions was $100 million to $300 million per FTE. A more detailed analysis, beyond the scope of this evaluation, would be required to understand the reasons behind this high number.

80% of the volume of the Retail Debt Program activity occurs in the month of November, when bond maturities trigger a high volume of redemptions of the paper certificates in the cash sales channel that are processed by HP, Furthermore, additional staff are hired on contract in the call center during the sales campaign time frame to help ensure contractual service levels are achieved (e.g., timely response to customer inquiries.)

The HP back-office is organized into 3 separate yet highly integrated and inter-related organizational units each with dedicated staff, i.e., Business Performance Office, Infrastructure Technology Outsourcing, and Applications Service Delivery.

Retail Debt Program support is delivered on a 24 x 7 basis with both on-line access and Interactive Voice Response (IVR). Call center support is available to Canadians during business operating hours (i.e., Monday to Friday 8 to 8 pm ET). There are also employer-based campaign directors, who can provide support to employees on the payroll sales channel. Campaign directors, financial institutions and investment dealers are also supplied with materials from the Bank to help respond to customer inquiries. Information Technology Infrastructure Library (ITIL) practices, processes and standards are followed and highly redundant processes have been established in the Infrastructure Technology Outsourcing area.

The Application Delivery Services practices and processes are governed by HP's global leading practices.

Performance measures have been clearly defined and are continually monitored, tracked and reported against via a Balance Score Card report (monthly and quarterly). In addition, when issues or problems (real or perceived) occur, a Service Excellence Dashboard tool is used to report on, record, track, and monitor solutions (weekly and monthly).

A formal Quality Program is in place to track, monitor, and report on customer complaints and identify trends and opportunities for improvement.

Business continuity and disaster recovery plans are in place, and drills are run twice annually with the entire Retail Debt Program team to help ensure readiness in the event of a disaster. In addition, an annual security plan is prepared and approved.

Since the time of Retail Debt Program outsourcing, continuous back-office business performance improvement has been a priority, with numerous projects having been executed to streamline operations and optimize management and delivery cost. This said, there has been no meaningful modernization of legacy technology, and the existing legacy technology is a constraining factor for the achievement of meaningful delivery cost reductions in the future.

3.3 Question 3: To what extent are the Retail Debt Program mandate and policies consistent with federal government roles, responsibilities, and priorities?

To address this question the following were considered:

- A number of documents, including: World Bank and International Monetary Fund studies, Government of Canada policy papers on debt management, Retail Debt Program strategic plans, an external evaluation, Government of Canada budget documents, and Government of Canada debt management strategy papers.

- The results of interviews with Bank of Canada and Department of Finance officials to confirm the findings from the document review.

- The retail debt-related policies of other jurisdictions (which were reviewed to see if they were generally consistent with the policies recommended in the World Bank and International Monetary Fund studies).

Findings

- A retail debt program is consistent with the roles and responsibilities of sovereign governments historically.

- The Retail Debt Program is aligned with the federal government's roles, responsibilities, and priorities and in particular, the government's priority of providing equitable access to safe, low risk investment instruments to all Canadians.

- However, the mature domestic financial retail market in Canada reduces the value and need for a retail debt program.

Analysis and supporting evidence

Unpublished literature on debt capital markets (mainly through the World Bank) indicates that retail debt programs have a long history in the placement of government debt. Implementation of a retail debt program by sovereign governments generally supports two purposes: 1) to raise funding and 2) to develop the domestic financial retail market.

The debt management objectives of the Government of Canada are consistent with this. The stated fundamental objective of debt management for the Government of Canada is to raise stable and low-cost funding to meet the financial needs of the Government of Canada. An associated objective is to maintain a well-functioning market in Government of Canada securities, which helps to keep debt costs low and stable, and is generally to the benefit of a wide array of domestic market participants.

These stated objectives have remained constant since reported in the Government of Canada's Debt Management Strategy in 1998/99 and likely before that.

The Guidelines for Public Debt Management, prepared by the International Monetary Fund and the World Bank, state that: "The government should strive to achieve a broad investor base for its domestic and foreign obligations, with due regard to cost and risk, and should treat investors equitably. Debt issuers can support this objective by diversifying the stock of debt across the yield curve or through a range of market instruments."

Canada has had a vested interest in broadening its investor base, as commonly reported in Debt Management Reports[5]. By having a diversified investor base, the stock of debt is less exposed to interest rate changes caused by shifts in investor preferences. Diversification is pursued by borrowing using a variety of instruments and a range of maturities that is attractive to a wide range of investors.

At the International Retail Debt Management Symposium 2012, Canada identified its Retail Debt Program as a program that represents the government's continuing commitment to providing Canadians with a means to save for their financial goals in a way that is safe, convenient and free of charge. The federal government's focus in recent years on the importance of personal savings has been further demonstrated by its introduction of the Tax Free Savings Account and a number of papers published by the Bank of Canada[6] dealing with the importance of personal savings to the national economy.

It was also agreed at this symposium that the decline of a sovereign government's retail debt program is usually a positive indication that wholesale funding sources and the domestic banking system are well-developed and able to more efficiently take over.

This is happening in Canada: As discussed under question 1, a large number of Canadians are opting for private-sector sponsored investment vehicles, and the level of outstanding Retail Debt Program bonds is now a very small portion of the Government of Canada's total market debt. Therefore, although the role of government in the retail space is valid, the Retail Debt Program is not seen as a source of funds.

3.4 Question 4: To what extent has the Retail Debt Program provided Canadians with access to retail savings products in a cost-effective manner?

To address this question, the following was done:

- Analysis of statistical evidence regarding Retail Debt Program pricing in comparison to wholesale rates and yields offered on comparable CDIC insured retails savings alternatives.

- Review of cost budget forecast in relation to the outstanding stock forecast.

- Review of the evolution of the various categories of expenditures required to run the Retail Debt Program.

- Comparison with cost structures and trends seen in other jurisdictions.

Findings

- Multiple initiatives have been taken to rationalize and improve the Retail Debt Program, leaving very few avenues for additional cost saving measures in the Retail Debt Program's current state. But despite all the cost savings measures adopted, the unitary administrative and operational costs of the Retail Debt Program continue to augment. The economies of scale are simply not there anymore.

- It is no longer possible to operate the Retail Debt Program in a cost-effective manner while offering savings instruments at attractive rates despite substantial cost reduction efforts accomplished over the last few campaigns. This is mainly due to legacy expenditures (e.g., high level of fixed costs and trailer fees) combined with low outstanding retail debt stock and ongoing low-interest rate levels.

- Canada probably has the highest unitary operations cost among the jurisdictions for which we could obtain comparative information, although it is acknowledged that the mandate and financial markets of other jurisdictions are different from the ones in Canada, and thus operations costs are not strictly comparable.

Analysis and supporting evidence

The pricing approach adopted by the Department of Finance over the last few years has been to set the rates of CSBs and CPBs slightly lower than comparable retail instruments (i.e., Guaranteed Investment Certificates (GICs) of similar maturities). The pricing methodology used has been consistent and in line with the policy to offer a fair rate to Canadians that reflects the characteristics and credit quality of Government of Canada retail savings instruments. As such, it is deemed that CSBs and CPBs have been priced reasonably with regards to market competition.

Due to a combination of factors such as the low level of wholesale rates, the competitive nature of private sector GIC rates and rising unitary administrative costs, it has been more expensive for the Government of Canada to issue CSBs and CPBs than to issue on the wholesale market.

The cost-effective rate is represented by the following formula:

Cost-effective rate = wholesale rate (same maturity) – Unitary admin cost – Option[7] cost.

As long as wholesale rates remain very low and unitary administrative costs continue to increase (due to stock declining faster than administration cost), the cost-effective rate will be lower than the rate that has to be offered on CPBs and CSBs in order to be comparable with GICs rates.

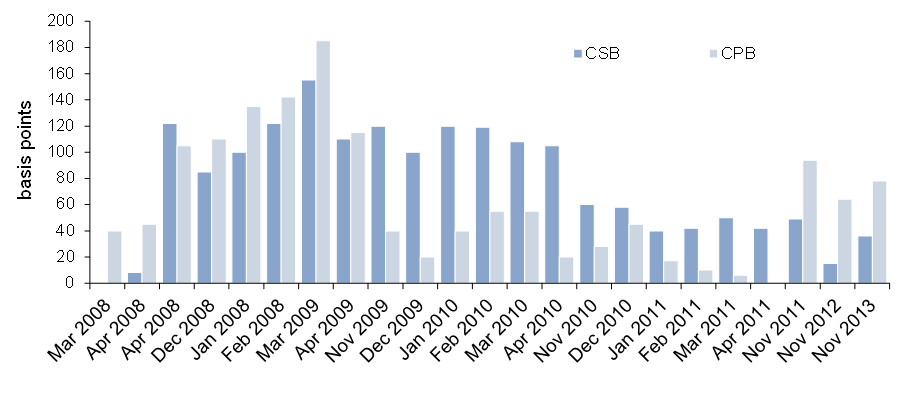

Evolution of the relative spread between the cost effective rates and rates offered on CPBs and CSBs

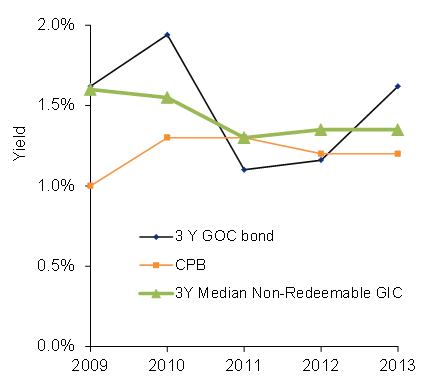

We notice that the CPB rate is tracking closely the 3-year benchmark Government of Canada bond since 2008 with a spread ranging between minus 20 to plus 60 basis points (bps) leaving little or no margin to offset unit administration and option costs (see Chart 6). Likewise, the CSB rate, even with spreads ranging from 10 to 70 bps compared to the 1 year treasury bill rate since 2009 does not leave enough margin to cover unit administration and option costs.

Evolution of CSB and CPB Rates Compared with their Respective Benchmark Yields

Today, the operating costs of the Retail Debt Program at $58 million are equivalent to the yearly interest costs (approx. $58 million) on the outstanding stock of retail debt (see Chart 7). Of course this relation may change in the future, based on the evolution of interest rates and changes in the cost structure. It is nevertheless an interesting snapshot putting the overall costs of the Retail Debt Program in perspective.

The largest component of the operating costs for the Retail Debt Program is the HP back-office operations which stand at $36 million or 62% of the expenses.

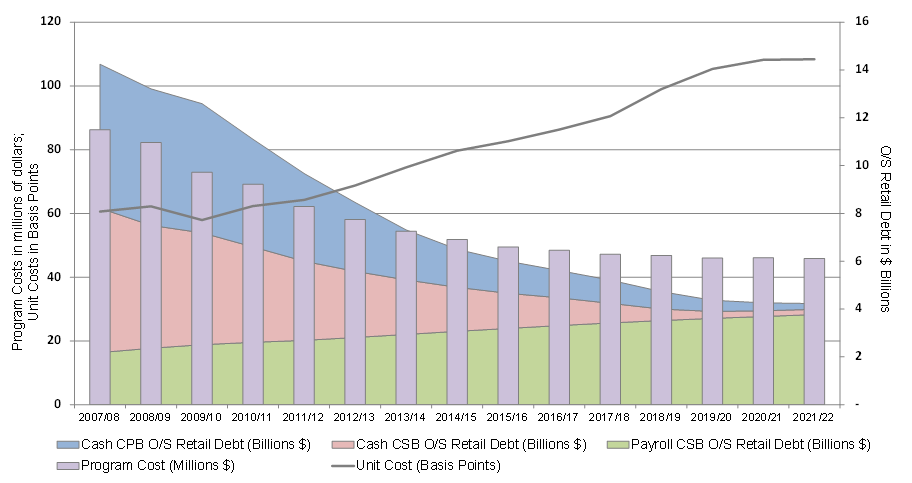

Evolution of Retail Debt Program Costs

For the Retail Debt Program, the split between fixed and variable costs is 78%/22%.

Average Debt Outstanding Forecast by Product/Channel, Program Cost and Unit Cost

We see from Chart 8 that unitary (non interest) costs of the Retail Debt Program stood at 76 basis points (bps) for the current campaign and are projected to grow to over 100 bps by 2020, due mainly to the decreasing outstanding stock. In comparable jurisdictions for which we obtained unit costs information we saw a range of 8 to 20 bps. This indicates that the current operating costs of the Canada Retail Debt Program are unsustainable.

Marginal cost of sales

The payroll sales channel (which is the only channel still slightly growing) entails relatively high costs to establish new enrollments. It is estimated that there is a new employee set up cost of 50-60 bps for new customer sales linked to the payroll sales channel, as well as a high turnover of participants (see Table 3). On the other hand the payroll sales channel offers the lowest marginal cost of sales for existing customers at 6 bps. Estimated marginal costs per channel are as follows:

| Channel | New customer | Existing customer |

|---|---|---|

| Payroll (CSB) | 58 | 6 |

| Investment Dealers (CPB) | 12 | 12 |

| Banks (CPB) | 32 | 11 |

| Direct phone (CPB) | 61 | 41 |

The legacy of trailer fees

Introduced in 1997 by Canada Investment and Savings Agency (CI&S), trailer fees were discontinued in the fall of 2010 and replaced by an up-front 35 bps commission. This proved a significant cost reduction measure. Beforehand, financial institutions benefitted from annual trailer fees of 23 bps until maturity. In 2009 trailer fees accounted for 93% of total commissions to financial institutions.

Based on the pre-2000 issues still outstanding and on the estimated pace of redemptions, trailer fees are expected to end in 2019-2020. We estimate that in 2012-2013 they still represent approximately 92% of the commission expense as this would be consistent with $3.5 billion of outstanding debt still being subject to the 23 bps trailer fee (see Table 4).

Furthermore, we believe that commissions are not a significant variable cost at this stage, as only a small portion of commissions is attributable to new sales. Commissions on new sales would likely represent less than $1 million of variable costs.

3.5 Question 5: To what extent are service levels and sales channels satisfactory to Canadians?

To address this question the following were considered:

- The perceptions, opinions and experience of interviewed employer-based campaign directors.

- CSB Customer Satisfaction Survey Responses from 2012.

- Responses from a 2010 Ipsos Reid Survey.

Findings

- The current service levels and sales channels are satisfactory to Canadians who purchase, hold, and redeem CSBs and CPBs.

- Representatives from all sales channels are satisfied with service levels.

Analysis and supporting evidence

Redemptions are significant, as shown below in Chart 9. However, they do not generate a material level of complaints, either by clients or by financial institutions, investment dealers or employers.

Interviewed campaign directors reported being very satisfied with the nature, quality and level of service and support provided to them during the annual CSB campaign. They reported that field service representatives are always available when needed, knowledgeable and informative, proactive in their communication, and helpful in providing information and materials. When asked about employee satisfaction with the channel and service, it was suggested that there is an overall high degree of satisfaction.

Interviewed financial institution representatives reported being very satisfied with the degree, quality and timeliness of communication and supporting materials received from Bank of Canada representatives in preparation for the launch of the campaign. They also reported being very satisfied with the quality and level of service and support received from the back-office in connection with sales, redemption, and settlement processes.

Interviewed investment dealer representatives also reported that they were satisfied with services received from the Bank of Canada representatives and that they had not heard any complaints from clients as far as they could remember.

Customer survey highlights

Through the review of 2012 CSB Client Satisfaction Survey responses and 2010 Ipsos Reid Survey, it appears that overall CSB holders are satisfied with the payroll sales channel and the contact centre customer service and support received.

The Ipsos Reid Survey reported there being little overlap between CSB and CPB owners who purchase through the payroll sales channel and those who purchase through a cash sales channel (only 8% of survey respondents reported buying through both channels). Further, the survey results suggest CSB owners more often view CSBs as easy to buy (90% payroll, 79% cash), easy to redeem (91% payroll, 71% cash), good for short-term savings goals (84% payroll, 51% cash), and designed for people like them (81% payroll, 54% cash). In addition, ninety percent of the Ipsos Reid survey respondents reported being satisfied with the CSB website.

Some CSB Client Satisfaction Survey respondents suggested they would like to have:

- Performance improvements made to the on-line application used to create and maintain their account.

- Faster redemption and settlement processes (as reported under Question 2).

- The ability to purchase CSBs through automatic monthly bank withdrawals.

3.6 Question 6: To what extent have marketing, advertising, and communications been effective in providing necessary information to potential buyers? Is 'awareness' the right objective?

To address this question the following were considered:

- The perceptions, opinions and experience of interviewed:

- Employer-based campaign directors.

- Financial institution representatives.

- Bank of Canada and Department of Finance representatives.

- Responses from a 2012 Campaign Director Survey.

- Responses from the January 2010 Ipsos Reid Survey.

- The 2008 CSB Advertising and Website Evaluation Annual Tracking Study.

Findings

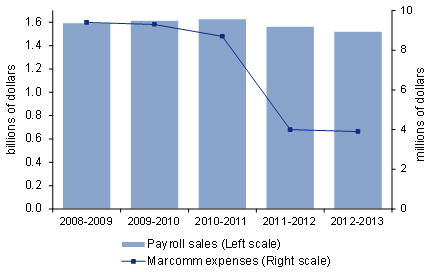

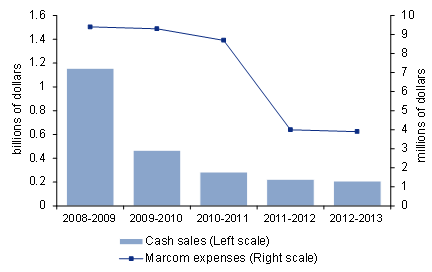

- The cuts made to the Retail Debt Program advertising budget since 2010-11 were accompanied by a marked decrease in the sales of Retail Debt Program instruments. However, the extent to which this was due to advertising cuts as opposed to other factors is not clear.

- The focus of Retail Debt Program marketing and communications efforts have shifted more heavily toward the payroll sales channel in recent years;[8] the employer-based campaign directors are highly satisfied with the Bank of Canada's efforts in this area, although about a third of them have suggested that additional support materials would be helpful.

- With regard to the cash sales channel, the proliferation of competitively priced CDIC insured alternative instruments is viewed as the main factor in the sales decline.

- In summary, the marketing and communications activities are seen effective in supporting the payroll and cash sales channel.

- The objective of "awareness" is seen as an appropriate objective for marketing and advertising purposes, but more clarity is needed regarding this objective and the associated expected results, targets, and indicators.

Analysis and supporting evidence

Chart 10 illustrates that the volume of sales went down slightly around the time that the advertising expenses were cut. This could well have been attributable to factors other than decreased advertising – in particular, the proliferation of competitively priced CDIC insured alternative instruments. To the extent that advertising may have been a factor in the decline in sales volumes, it appears that the impact was more pronounced in the cash sales channel, possibly reflecting the increased focus in marketing and communications activities towards promoting the payroll sales channel.

Sales per Channel and Marketing/Communications Expenses

CSB – payroll sales channel

The focus of the marketing and communications efforts has shifted more heavily toward the CSB payroll sales channel over recent years. The role of the employer-based campaign director in this channel is critically important to the success of a sales campaign and so marketing efforts have particularly focused on ensuring campaign directors have the information, knowledge and materials necessary to run an efficient and effective campaign.

In addition to the campaign director community, contractual regional account managers provide support to campaign directors and strive to increase the number of participating employer organizations each year. To provide focus and measurability to this objective, growth targets are set and measured for each regional account manager.

Based on feedback from interviewed campaign directors, there appears to be a relatively high degree of satisfaction with marketing efforts. Campaign directors reported having sufficient information and materials to effectively provide existing and potential CSB buyers with the information needed to support decision-making and account maintenance.

In addition to receiving a sufficient amount of information to plan and run the payroll sales channel campaign, interviewed campaign directors also reported that information and materials received from the Bank of Canada are readable and concise but at times in an over-abundance, particularly in the case of brochures and posters.

In the 2012 survey responses, 37% of the 2012 Campaign Director Survey respondents indicated that more on-line promotional material for employees would help them further promote the payroll sales channel, and 29% indicated that more printed material for employees would also assist with this objective.

The campaign directors expressed mixed views concerning the need and/or benefit of additional promotion and awareness efforts. Some expressed an opinion that there is an insufficient amount of promotion on the part of the Government and that this is likely negatively impacting Canadian's awareness of the payroll sales channel offering. However, others expressed a view that traditional media for marketing and advertising CSBs such as television ads and paper-based material are less effective than in the past and thus, increasing such efforts would bring little benefit.

CPB – cash sales channel

Interviewed financial institution representatives believe that the Government's reduced efforts and spending on advertising and promotion has had little to no impact on the volume of CPBs purchased by Canadians and/or their organization's ability to sell CPBs. Further, they reported not having seen a marked decline in CPB sales since the scale back of marketing advertising and communications[9] and they do not anticipate an increase in purchases should marketing, advertising and communications efforts be increased. Interviewed representatives believe that the most important factor for Canadian investors is the interest rate one can expect to receive from their investment instruments and unfortunately, the CPB interest rate over the past number of years and into the foreseeable future is considered unattractive to most Canadian investors. Finally, they reported having sufficient information from the Government to educate and sell CPBs to their clients.

The objective of 'Awareness'

It was consistently stated by Department of Finance and Bank of Canada interviewees that this was and is a Government policy directive and, in effect, is respected and adhered to. There was, however, discussion among some interviewed representatives about the need for increased clarity surrounding this objective in terms of what outcomes are desired and what key performance indicators and targets should be defined to help enable performance measurement, reporting, and tracking of progress and impact in a more objective and focused manner.

3.7 Question 7: To what extent do the governance structure and accountabilities safeguard the interests of Canadians, as well as the interests of the federal government?

Note: In this section we use the term "governance framework" to include both the governance structure and the associated system of accountabilities, and we distinguish between the overall governance framework for the Retail Debt Program and the governance framework for the HP contract (i.e., the framework for the management of this contract by Bank of Canada).

To address this question the following were considered:

- Results of Interviews with representatives of Department of Finance, Bank of Canada, and HP management.

- Available documentation and data in relation to the two governance frameworks, including:

- The Funds Management Governance Framework.

- The Contract Governance Model within the Agreement between the Bank of Canada and HP.

- Memorandum of Understanding between the Department of Finance and the Bank of Canada.

- Associated documents such as minutes of committee meetings, the Contract Governance Model Overview (chart), performance reports and other internal documents related to the HP contract.

- Comparison of the current governance frameworks with leading practices.

Findings

- The overall governance framework for the Retail Debt Program is aligned with leading practices.

- The overall governance framework for the Retail Debt Program is clearly understood and accepted by both the Department of Finance and the Bank of Canada.

- The governance framework for the oversight of the ongoing HP contract is aligned with leading practices related to the governance of outsourced services. It is clearly understood and accepted by both the Bank of Canada and HP, and both parties feel it is working well.

- There may be value in enhancing the level of consultations and information sharing between the Bank of Canada and the Department of Finance with regard to key decisions and outsourcing costs.

Analysis and supporting evidence

We first discuss the overall governance framework for the Retail Debt Program, and then the governance framework for the HP contract.

The overall governance framework

Leading practices[10] suggest a strong governance framework should address the following:

- Operating model: What is the overall structure used in governing?

- Roles and responsibilities: What roles and responsibilities exist at each level to facilitate effective governance, and are the reporting relationships clearly defined?

- Processes: What are the key processes in place that enable sound governance?

- Enabling technology (if applicable): What are the tools in place that enable management oversight?

Comparison with leading practices and our interviews with Department of Finance and Bank of Canada representatives indicate that the overall governance framework for the Retail Debt Program is satisfactory, in particular:

- The overall structure used in governing is clearly defined;

- Roles, responsibilities, and reporting relationships are defined, documented, understood, and accepted by all stakeholders;

- Processes are laid out for program management, service and program delivery, and change and issues management.

The first two of these items are described in the Funds Management Governance Framework. Our interviews confirmed that the governance framework is clearly understood and accepted by both the Bank of Canada and Department of Finance and that processes are laid out for program management, service and program delivery, and change and issues management.

The oversight of the Retail Debt Program is largely carried out through the work of two committees, as shown in the Text Box 1.

Text Box 1: Governance – Retail Debt

The Retail Debt Committee (RDC) provides recommendations on retail debt strategy policy matters and annual work plans; develops the work plan for the year; coordinates initiatives and campaign issues and pricing; and decides on policy recommendations to bring forward.

The Retail Debt Working Group (RDWG) is responsible for reporting to the RDC on the management of the program and program outcomes and formulating, informing, and advising the RDC on related policies and strategies.

Both committees are comprised of representatives from Department of Finance and Bank of Canada, and typically meet every month or as needed. Our review of selected minutes of these committees indicates that they deal with the full range of program management issues on a timely basis. Representatives of both Department of Finance and Bank of Canada attend, and action items are listed addressing typical issues within program management and include due dates and status.

Both parties agree with the overall soundness of the framework and understand their roles, responsibilities and the escalation process. However, based on our interviews, it appears that there may be value in enhancing the level of consultations and information sharing pertaining to key decisions, as well as information regarding costs of the outsourcing contract and headcount. This would increase the overall effectiveness of the governance framework in safeguarding the interests of the Government (and Canadians).

Governance of the contractual agreement between Bank of Canada and HP

Comparison with leading practices and our interviews with Bank of Canada and HP representatives indicate that the governance framework for the HP contract is satisfactory, in particular:

- The overall structure used in governing is clearly defined;

- Roles, responsibilities, and reporting relationships are defined, documented, understood and accepted by all stakeholders;

- Processes are laid out for program management, service and program delivery, and change and issues management.

- Enabling technology is used appropriately to enable management oversight.

The first two of these items are described in the Contract Governance Model in the Agreement between the Bank of Canada and HP. Our interviews and walkthrough of the HP facilities confirmed that this governance framework is clearly understood and accepted by both Bank of Canada and HP. Our interviews and walkthrough of the HP facilities confirmed the third and fourth items in that processes are laid out for program management, service and program delivery, and change and issues management, and that enabling technology is used appropriately to enable management oversight. The fourth item is further discussed below.

Five committees facilitate the coordination and control of work activities for this contract, as shown in the Text Box 2.

Text Box 2: Governance – Bank of Canada and HP

The Senior Stakeholder Committee discusses corporate direction and upcoming initiatives that may relate to HP's Strategy and the impact on the services business. This committee typically meets twice annually.

The Delivery Management Committee (DMC) is responsible for approval of changes to the Agreement and overall relationship between the Bank and HP. This committee typically meets every month. Should issues arise, a dispute resolution process is enacted as outlined in the Agreement.

The Contract Management Committee (CMC) is accountable for service delivery, day to day operational issues, invoices, monitoring upcoming contractual obligations, coordinating and recommending contract amendments to DMC. This committee typically meets weekly; however issues may be addressed on a more frequent basis as they arise. Should issues arise, they are escalated to the DMC.

The Change Control Board (CCB) is responsible for reviewing all change status, analysis of change impact, clarification of the underlying assumptions related to change and resolving change issues. This committee typically meets weekly; however issues may be addressed more frequently, as they arise. Should issues arise, they are escalated to the CMC.

The Campaign Committee is responsible for the planning, execution and tactical/operational issues of campaign activities. This committee meets several times per week or, as issues arises.

All these committees are composed of representatives from the Bank of Canada and HP. Our review of selected minutes of these committees indicates that they deal with the full range of contract management issues on a timely basis.

The enabling technology bullet above is addressed by the Balanced Scorecard and Service Excellence Dashboards, which are used to track, measure and report on performance of the back-office operations. The Balanced Scorecard is prepared monthly for the Contract Management Committee and quarterly for the Delivery Management Committee. The Balanced Scorecard enables the Bank of Canada to measure how well the Retail Debt Program is achieving objectives, and to identify trends. The Service Excellence Dashboard is a web-based tool that is reported on weekly, and it is summarized in the Balanced Scorecard on a monthly basis.

Our review of the June 2013 Balanced Scorecard report indicates that retail debt back-office operations are operating effectively, with no significant events and/or issues reported. In addition, the report indicates that the four traditional perspectives of the Balanced Scorecard (i.e., financial, customer, internal processes, and learning and growth) are on track with targets.

HP adheres to the ITIL (Information Technology Infrastructure Library)[11] framework for operational service management of the IT infrastructure, which is a globally recognized framework.

Internal documents reviewed provide a high-level comparison of the governance structure established between Bank of Canada and HP against industry leading practices for outsourcing of back-office operations and systems support services. These indicate that the contract with HP seems consistent with outsourcing leading practices in that "(it) defines responsibilities of the two parties in terms of upgrades and modernization of systems and applications".

According to the Bank of Canada and HP interviewees, the governance framework in place works well and is considered a key factor to the functioning of the business arrangement.

3.8 Question 8: To what extent do the management and operational systems and associated procedures (including the outsourcing of back office operations) effectively and efficiently support delivery of the Retail Debt Program?

To address this question the following were considered:

- Results of interviews with Department of Finance and Bank of Canada officials, as well as HP leadership and management representatives.

- Information obtained from a walkthrough of the back-office operations at HP.

- Documentation and data relating to the back-office operations.

Overall findings

- The management and operational systems and procedures effectively support the delivery of the Retail Debt Program.

- Retail debt programs of the other jurisdictions reviewed appear to be significantly more efficient than the Canadian program.

Analysis and supporting evidence

It is important to distinguish between the two distinct retail debt instruments (i.e., CPBs and CSBs) and delivery channels (i.e., the payroll sales channel and the cash sales channel) when addressing this question. To this end the key findings are presented overall, and for each instrument and channel.

Overall

Interviews with Bank of Canada officials indicate a high level of satisfaction with the back office operations as there is a low number of service level requirement breaches, failures, and customer complaints.

As discussed under question 7, our review of the contract documents of the Bank of Canada and HP agreement show that program management and delivery roles and responsibilities are clearly defined, understood, and adhered to. In addition, management and delivery practices and processes are documented and have been implemented and maintained with the objective of achieving and maintaining consistency and standardization.

Our review and walkthrough of the back-office operations at HP indicate that several processes and procedures are in place to support an efficient and effective delivery of the Retail Debt Program. For example:

- All incoming mail is sorted and categorized according to the type of inquiry to ensure service level agreements are satisfied. In addition, a case management system with a built-in custom workflow is used to analyze and respond to client inquiries. Case agents are trained according to the respective complexity of inquiries.

- An Interactive Voice Response system is used to triage calls depending on the type of call to ensure service level agreements are satisfied. Call center agents are also trained according to the respective complexity of inquiries.

- The report on the CSB Client Satisfaction Survey conducted in 2012 included mostly positive feedback about customer service. The June 2013 Balance Scorecard reports 133 customer complaints about service between June 2012 and June 2013 – this represents approximately a 0.02% complaint rate. The Balanced Scorecard, reports no service level requirement failures related to the call center during that timeframe.

- Temporary resources are hired in the call centre by HP to support the increased volume of activity experienced during campaigns for both paperwork and calls, which is a cost-effective measure for managing costs during off-peak periods and maintaining efficiency and effectiveness during campaigns.

- A second call center to handle less complex inquiries has been set-up in Winnipeg in an existing facility as a cost-effective measure.

- The employer help desk is dedicated to managing calls from campaign directors. It is reported that 4 dedicated employer help desk agents handle on average 150-200 calls per day, although during the sales campaign this number could increase to 250-350 calls per day.

- Retail Debt Program support is delivered on a 24 X 7 basis with both on-line access and interactive voice response (IVR). Call center support is available during business operating hours on a 5 days X 8 to 8 ET basis to Canadians, employer-based campaign directors, financial institutions and investment dealers.

As discussed under Question 7, issues are documented in the Service Excellence Dashboard weekly and the Balance Scorecard monthly and are addressed and escalated with the appropriate stakeholders as necessary.

As evidenced by a review of a Service Level Credit Report for the period April 1 – 30, 2013, there are very few service level failures between fiscal years 2004-05 and 2012-13 (see Table 5).

| Year | 2004-05 | 2005-06 | 2006-07 | 2007-08 | 2008-09 | 2009-10 | 2010-11 | 2011-12 | 2012-13 |

|---|---|---|---|---|---|---|---|---|---|

| Number of Failures | 8 | 4 | 1 | - | 2 | - | 3 | 2 | 3 |

Since the outsourcing of the back office operations of the Retail Debt Program in 2001, a series of incremental management and operational enhancements have been made to improve overall Retail Debt Program systems and procedures. These have included:

- Security enhancements projects which enabled the protection of personal information and improved authentication methodology.

- Streamlining the processes used by employers to allocate their employee payroll contributions to the purchase of bonds.

- Accounting improvements to facilitate the reconciliation of payment contributions and settlements.

- Reduction of the number of CSB registration types.

- Improvements to the mainframe systems used to support the cash and payroll sales channels.

- Improvements to enable self-service delivery for the payroll sales channel.

- The implementation of a change to the call center service level to be comparable with private sector services and better than other public sector call centers.

- The implementation of the leveraged contact center in Winnipeg.

- Implementation of a more cost-effective model for the delivery of application maintenance and support.

After a one-time funding investment of $11.6 million, shared equally by the Bank of Canada and HP and spent over three years beginning in 2007, annual savings for back office operations have been reported at approximately $6.5 million per year. Our analysis did not explore the extent to which reductions in operating costs are due to this funding investment as opposed to declining volumes or a reflection of the new pricing model implemented in April 2007.

Internal Department of Finance documents indicate that the per unit cost of the Retail Debt Program was forecasted at 69 bps for 2012. By contrast, other jurisdictions interviewed for this evaluation indicated per unit costs between 8 and 20 bps. Although the programs may not be fully comparable, this suggests that the Canadian program is expensive on a unit cost basis.

We know that approximately 200 resources are dedicated to the Retail Debt Program at HP, and 20 at the Bank of Canada. As reported under question 2, Canada's Retail Debt Program requires considerably more resources to deliver than the jurisdictions reviewed.

HP currently runs more than 30 applications in the delivery and management of the Retail Debt Program - nine of which are mainframe based. This poses both efficiency and risk concerns, as there may be a high degree of fragmentation of information, a higher cost associated with running mainframe applications, and risk of continued access to resources that are skilled in the required programming languages. There is likely a need for rationalization of applications to drive increased efficiency, decrease fragmentation, reduce costs, and thus reduce risk.

CPB - legacy cash sales channel

CPBs are sold and redeemed primarily through financial institutions via their respective internal management and operational systems and procedures with the support and settlement performed by HP. Interviews conducted with representatives of four financial institutions through the course of these discussions concluded that:

- The systems and procedures to sell and redeem CPBs are relatively similar among all four institutions with one notable difference: One of the four (and reportedly a fifth financial institution) offers clients a fully automated CPB purchase process. The other three financial institutions offer a purchasing process which is primarily paper-based.

- There was no evidence to suggest that the financial institutions and/or their clients perceive the CPB purchasing/selling process to be inefficient or ineffective.

- The redemption process appears to be virtually identical among the four interviewed financial institutions (recognizing of course that each has its own specific management and operational procedures and systems).

While a detailed review of the financial institutions processes and systems was not undertaken as part of the scope of this evaluation, we have concluded through the interview process that the process and systems are seen to be relatively effective. In a Monthly Summary Complaint Report about customer complaints regarding financial institutions prepared for the 2012 Campaign the total number of complaints from customers concerning the current business processes or service delivery methods were negligible – 12 in 2012 and 4 in 2011.

However, as discussed further under question 9, the sales and redemption processes for CPBs are inefficient relative to today's market trend due to the nature of processing physical bond certificates.

CSBs - payroll sales channel

As discussed under question 2, campaign directors view the payroll sales channel as having efficient and effective practices and delivery methods requiring minimal administration responsibilities from participating organizations. Employers have a very limited role in sales, maintenance and redemption as the payroll sales channel is offered online.

The online tool for employees enables self-service efficiency in the delivery of the Retail Debt Program by reducing the amount of paperwork and potential enquiries otherwise handled by HP and/or campaign directors. In the CSB Client Satisfaction Survey conducted in 2012, 92% of respondents indicated being satisfied or very satisfied with CSB online services. Only 8.7% of all payroll redemptions are processed through a customer service representative. The rest are all processed via self-service online.

As discussed under questions 5 and 6, campaign regional account managers responsible for developing and maintaining relationships with existing employers are hired on a contractual basis from May to the end of the campaign period which is cost-effective and supports the effective delivery of the Retail Debt Program. A remuneration program linked to targets for increased program take-up by new employers further supports effectiveness. Campaign directors interviewed indicated that they were all satisfied with the service they were receiving from the account managers, which further suggests effectiveness of the model.

3.9 Question 9: To what extent do issuance and redemption channels operate efficiently and do they make sense?

To address this question the following were considered: