Departmental Performance Report

for the period ending March 31, 2013

Table of contents

- How to use this Departmental Performance Report

- Minister's Message

- Raison d'être and Responsibilities

- Strategic Outcomes and Program Alignment Architecture

- Organizational Priorities

- Risk Analysis

- Summary of Performance, Expenditure Profile and Estimates by Vote

- Contribution to the Federal Sustainable Development Strategy

- Analysis of Programs and Sub-Programs by Strategic Outcome

- Financial Statements Highlights and Financial Statements

- Supplementary Information Tables

- Tax Expenditures and Evaluations Report

- Organizational Contact Information

How to use this Departmental Performance Report

This Departmental Performance Report (DPR) presents the results of Industry Canada's programs and services in 2012–13, compared with the commitments stated in the Department's 2012–13 Report on Plans and Priorities (RPP).

The report is made up of multiple webpages that allow readers to navigate quickly between topics of interest. This is achieved using multiple links within each webpage that connect to related external sites and other webpages within the report. Navigability is further enhanced with a floating tab on the right-hand side of each page that gives users access to the full Table of Contents without having to navigate away from the current page.

Should you have any comments on this report or are having difficulty using the report, please communicate with us via mail, email or fax as listed below:

Corporate Planning and Governance

Comptrollership and Administration Sector

Industry Canada

235 Queen Street

2nd Floor, East Tower

Ottawa ON K1A 0H5

Email: ic.info-info.ic@canada.ca

Fax: 613–957–6543

Minister's Message

I am pleased to present the Industry Canada Departmental Performance Report for 2012–13 to Parliament and Canadians.

This report outlines how our government continues to take action to represent the interests of Canadian consumers in the wireless sector. These actions have resulted in more choice, lower prices and better service for Canadian families. We modernized Canada's copyright laws to balance the interests of creators and consumers, and we introduced new legislation to protect Canadians from counterfeit goods and to enforce intellectual property rights.

We also put in place measures to maintain Canada's foreign investment regime as one of the most favourable in the world. These included clarifying the review process for investments by state-owned enterprises and focusing on the most significant foreign investment proposals.

Supporting the global competitiveness of Canadian industries, such as the aerospace and automotive sectors, remained a priority. The Automotive Innovation Fund was renewed for another five years, while a major Review of Aerospace and Space Programs and Policies was completed, resulting in a series of recommendations to strengthen these important sectors.

Our government continues to take action to encourage research and development in Canada. During this period, the National Research Council stepped up its transformation into an industry-focused research and technology organization. Significant investments were also made in programs such as the College and Community Innovation Program and the Centres of Excellence for Commercialization and Research.

Moving forward, we will continue to encourage more competition in Canada's telecommunications sector, which is in the best interest of consumers, and we will ensure that our manufacturing, aerospace and space sectors continue to be among the best in the world. We are committed to creating the right conditions for Canadian businesses and communities to prosper in the 21st century.

James Moore

Minister of Industry

Raison d'être and Responsibilities

Raison d'être

Mission

Industry Canada's mission is to foster a growing, competitive, knowledge-based Canadian economy.

The Department works with Canadians throughout the economy, and in all parts of the country, to improve conditions for investment, improve Canada's innovation performance, increase Canada's share of global trade and build an efficient and competitive marketplace.

Mandate

Industry Canada's mandate is to help make Canadian industry more productive and competitive in the global economy, thus improving the economic and social well-being of Canadians.

Responsibilities

Industry Canada's founding legislation, the Department of Industry Act, establishes the Department to foster a growing, competitive and knowledge-based Canadian economy.

The Department works on a broad range of matters related to industry and technology, trade and commerce, science, consumer affairs, corporations and corporate securities, competition and restraint of trade, weights and measures, bankruptcy and insolvency, intellectual property, investment, small business, and tourism.

Eleven departments and agencies make up the Industry Portfolio. Industry Canada works in partnership with the members of the Industry Portfolio to leverage resources and exploit synergies in a number of areas in order to further the Government of Canada's goal of building a knowledge-based economy in all regions of Canada and to advance the government's jobs and growth agenda.

Additional information on the Department and its structure is available on Industry Canada's website.

Strategic Outcomes and Program Alignment Architecture

Strategic Outcomes

This Departmental Performance Report (DPR) is aligned with Industry Canada's Management, Resources and Results Structure (MRRS). The MRRS provides a standard basis for reporting to parliamentarians and Canadians. It sets out how the Department's resources, programs and results provide long-term, enduring benefits to the lives of Canadians that reflect our mandate and mission, and how they are linked to Government of Canada priorities and outcomes. The activities Industry Canada carries out to deliver on its mandate are organized around three interdependent and mutually reinforcing strategic outcomes.

Strategic Outcome: The Canadian marketplace is efficient and competitive

Industry Canada fosters competitiveness by developing and administering economic framework policies that promote competition and innovation, support investment and entrepreneurial activity, and instil consumer, investor and business confidence.

Strategic Outcome: Advancements in science and technology, knowledge, and innovation strengthen the Canadian economy

Industry Canada invests in science and technology to generate knowledge and equip Canadians with the skills and training they need to compete and prosper in the global, knowledge-based economy. These investments help ensure that discoveries and breakthroughs take place here in Canada and that Canadians realize the associated social and economic benefits.

Strategic Outcome: Canadian businesses and communities are competitive

Industry Canada encourages business innovation and productivity because businesses generate jobs and create wealth. Promoting economic development in communities encourages the development of skills, ideas and opportunities across the country.

2012–13 Program Alignment Architecture

Industry Canada's Program Alignment Architecture (PAA) is an inventory of all of its programs. The programs are depicted in a logical and hierarchical relationship to each other and to the strategic outcome to which they contribute. The PAA also provides a framework that links financial and non-financial resources and results to each program.

This DPR is the first Industry Canada document to reflect the government's new reporting approach, providing detailed information at the lowest level of the PAA. To improve the usefulness of the information presented going forward, a number of reallocations were made in 2012–13 to better align planned spending at this lower level to where it actually occurs. This has given rise to a need to explain in-year variances at these lower levels throughout this document.

Below is a link to Industry Canada's 2012–13 PAA.

Industry Canada's 2012–13 Program Alignment Architecture

Organizational Priorities

The achievements highlighted below correspond to the organizational priorities set out in the 2012–13 Report on Plans and Priorities.

| Priority | Type | Strategic Outcome |

|---|---|---|

| Advancing the marketplace | Ongoing | The Canadian marketplace is efficient and competitive |

| Summary of Progress | ||

What progress has been made towards this priority?

|

||

| Priority | Type | Strategic Outcome |

|---|---|---|

| Fostering the knowledge-based economy | Ongoing | Advancements in science and technology, knowledge, and innovation strengthen the Canadian economy |

| Summary of Progress | ||

What progress has been made towards this priority?

|

||

| Priority | Type | Strategic Outcome |

|---|---|---|

| Supporting business | Ongoing | Canadian businesses and communities are competitive |

| Summary of Progress | ||

What progress has been made towards this priority?

|

||

| Priority | Type | Strategic Outcome |

|---|---|---|

| Ensuring sound management | Ongoing | All strategic outcomes |

| Summary of Progress | ||

What progress has been made towards this priority?

|

||

Risk Analysis

| Risk | Risk Response Strategy | Link to Program Alignment Architecture | Link to Organizational Priorities |

|---|---|---|---|

Demand for mobile services is increasing and access to spectrum continues to be an industry concern. |

|

Strategic Outcome: The Canadian marketplace is efficient and competitive Program: Spectrum, Telecommunications and the On-line Economy |

Priority: Advancing the marketplace |

Market conditions, as well as the structure of Industry Canada's R&D programs, may impact the schedule of disbursements under the programs and anticipated results. |

|

Strategic Outcome: Advancements in science and technology, knowledge, and innovation strengthen the Canadian economy Program: Research and Development Financing |

Priority: Fostering the knowledge-based economy |

Risk Narrative

Canada's economic and fiscal health is stronger than most developed countries. In 2012–13, Canada's economic recovery continued to show growth in domestic demand, led by household spending. The global economy, however, remained fragile, with advanced economies continuing to face economic challenges and emerging markets experiencing relatively strong growth.

Industry Canada's risk environment is shaped by the Department's mandate and objectives, government policies and priorities, as well as broader economic, social and technological trends. For 2012–13, Industry Canada's business imperatives were driven by two main objectives: preserving Canada's economic health in light of the unstable global economic conditions; and helping our businesses and communities enhance their productivity and innovation to position Canada to deal with the impact of an aging population and changing global economy.

To achieve these objectives, the Department balanced existing program requirements with the implementation of new government measures and priorities. In some instances, delivering program results—a key factor in maintaining public and stakeholder confidence in the Department—depended on the effective management of corporate risks.

Industry Canada addressed the impacts of government measures to improve efficiency, at the same time lowering the rate of growth of the public service, both in size and operations. These measures included freezing operating budgets at 2010–11 levels until the end of 2012–13; funding wage increases internally; and implementing results of the 2010 Strategic Review.

The risk table above identifies key risks from Industry Canada's 2012–13 Corporate Risk Profile, which is part of a tailored integrated risk management approach to proactively address risks that may impede the Department's overall ability to deliver on its mandate. This approach meets the Department's needs for sound risk management and allows it to monitor the mitigation strategies and action plans for its corporate risks.

Summary of Performance, Expenditure Profile and Estimates by Vote

Summary of Performance

The following tables present Industry Canada's total financial and human resources for 2012–13.

| Total Budgetary Expenditures (Main Estimates) 2012–13 |

Planned Spending 2012–13 |

Total Authorities (available for use) 2012–13 |

Actual Spending (authorities used) 2012–13 |

Difference (Planned vs. Actual Spending) |

|---|---|---|---|---|

| 1,306.1 | 1,445.4 | 1,650.7 | 1,357.6 | 87.8 |

| Planned 2012–13 |

Actual 2012–13 |

Difference 2012–13 |

|---|---|---|

| 5,395 | 4,839 | 556 |

Performance Summary Table for Strategic Outcomes and Programs ($ millions)

| Strategic Outcome | Program | Total Budgetary Expenditures (Main Estimates) 2012–13 |

Planned Spending | Total Authorities (available for use) 2012–13 |

Actual Spending (authorities used) |

Alignment to Government of Canada Outcomes | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2012–13 | 2013–14 | 2014–15 | 2012–13 | 2011–12 | 2010–11 | |||||

| The Canadian marketplace is efficient and competitive | Marketplace Frameworks and Regulations | 52.3 | 49.6 | 56.6 | 52.2 | 206.7 | 30.3 | 39.1 | 40.3 | Economic Affairs: A Fair and Secure Marketplace |

| Spectrum, Telecommunications and the Online Economy | 85.5 | 88.7 | 82.7 | 82.5 | 127.1 | 126.2 | 91.4 | 91.0 | ||

| Consumer Affairs | 4.6 | 4.5 | 4.5 | 4.5 | 4.8 | 4.6 | 4.8 | 5.0 | ||

| Competition Law Enforcement | 47.5 | 47.1 | 44.2 | 44.3 | 50.8 | 49.7 | 49.9 | 45.6 | ||

| Strategic Outcome Subtotal | 189.8 | 189.9 | 188.1 | 183.6 | 389.4 | 210.8 | 185.2 | 182.0 | ||

| Strategic Outcome | Program | Total Budgetary Expenditures (Main Estimates) 2012–13 |

Planned Spending | Total Authorities (available for use) 2012–13 |

Actual Spending (authorities used) |

Alignment to Government of Canada Outcomes | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2012–13 | 2013–14 | 2014–15 | 2012–13 | 2011–12 | 2010–11 | |||||

| Advancements in science and technology, knowledge, and innovation strengthen the Canadian economy | Science, Technology and Innovation Capacity | 336.6 | 350.6 | 307.8 | 217.0 | 418.2 | 415.9 | 440.8 | 1,068.9 | Economic Affairs: An Innovative and Knowledge-based Economy |

| Information and Communication Technologies Research and Innovation | 36.6 | 36.6 | 34.8 | 32.7 | 48.3 | 47.6 | 44.9 | 46.1 | ||

| Industrial Research and Development Financing | 403.2 | 483.0 | 355.7 | 255.3 | 430.7 | 349.2 | 332.9 | 247.0 | ||

| Strategic Outcome Subtotal | 776.5 | 870.3 | 698.3 | 504.9 | 897.3 | 812.7 | 818.6 | 1,362.1 | ||

| Strategic Outcome | Program | Total Budgetary Expenditures (Main Estimates) 2012–13 |

Planned Spending | Total Authorities (available for use) 2012–13 |

Actual Spending (authorities used) |

Alignment to Government of Canada Outcomes | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2012–13 | 2013–14 | 2014–15 | 2012–13 | 2011–12 | 2010–11 | |||||

| Canadian businesses and communities are competitive | Small Business Research, Advocacy and Services | 133.5 | 136.0 | 102.3 | 109.7 | 82.9 | 81.5 | 99.0 | 111.4 | Economic Affairs: Strong Economic Growth |

| Industrial Competitiveness and Capacity | 53.3 | 53.1 | 36.1 | 32.2 | 51.0 | 44.1 | 39.6 | 92.4 | ||

| Community Economic Development | 75.7 | 73.0 | 65.3 | 60.3 | 79.6 | 76.8 | 153.2 | 145.5 | ||

| Strategic Outcome Subtotal | 262.4 | 262.2 | 203.7 | 202.2 | 213.5 | 202.4 | 291.8 | 349.3 | ||

Performance Summary Table for Internal Services ($ millions)

| Program | Total Budgetary Expenditures (Main Estimates) 2012–13 |

Planned Spending | Total Authorities (available for use) 2012–13 |

Actual Spending (authorities used) |

||||

|---|---|---|---|---|---|---|---|---|

| 2012–13 | 2013–14 | 2014–15 | 2012–13 | 2011–12 | 2010–11 | |||

| Internal Services | 77.3 | 123.1 | 129.4 | 122.2 | 150.6 | 131.7 | 151.1 | 161.6 |

| Sub-Total | 77.3 | 123.1 | 129.4 | 122.2 | 150.6 | 131.7 | 151.1 | 161.6 |

Total Performance Summary Table ($ millions)

| Strategic Outcomes and Internal Services | Total Budgetary Expenditures (Main Estimates) 2012–13 |

Planned Spending | Total Authorities (available for use) 2012–13 |

Actual Spending (authorities used) |

||||

|---|---|---|---|---|---|---|---|---|

| 2012–13 | 2013–14 | 2014–15 | 2012–13 | 2011–12 | 2010–11 | |||

| Total | 1,306.1 | 1,445.4 | 1,219.6 | 1,012.9 | 1,650.7 | 1,357.6 | 1,446.7 | 2,055.0 |

Performance Summary Explanation

Strategic Outcome: The Canadian marketplace is efficient and competitive

The increase in Total Authorities for this Strategic Outcome is mainly related to fluctuations in two programs.

- The Canadian Intellectual Property Office (CIPO) is an organization within the Department that is funded entirely from the revenues it generates. CIPO accounts for a large portion of the Total Authorities figure for the Marketplace Frameworks and Regulations Program, which includes the surplus accumulated since CIPO's creation in 1994, as well as its deferred revenues. The intent is not to spend the accumulated surplus portion in any single year, but to draw down on it when expenses exceed revenues or when capital investments are required.

- The increases in Total Authorities and Actual Spending in 2012–13 under the Spectrum, Telecommunications and the Online Economy Program are related to one-time funding received in Supplementary Estimates for the payment of a settlement agreement.

For further information, please consult the Analysis of Programs and Sub-Programs by Strategic Outcome section of this report.

Strategic Outcome: Advancements in science and technology, knowledge, and innovation strengthen the Canadian economy

The change in Actual Spending since 2010–11 for this Strategic Outcome is mainly due to the completion of activities related to stimulus funding from Canada's Economic Action Plan 2009 (EAP) for the Knowledge Infrastructure Program. EAP initiatives are reported under the Science, Technology and Innovation Capacity Program. The funding announced in Budget 2012 to operate and develop the CANARIE network over a three-year period currently ends in 2014–15, which also contributes to the change.

Additional resources over a four-year period for the Industrial Research and Development Financing Program were announced in Budget 2009 to support investments in innovation under the Strategic Aerospace and Defence Initiative (SADI) Program. This time-limited additional funding ends in 2013–14. Budget 2013 provided SADI with stable funding for five years and announced the creation of a new technology demonstration program.

The original funding for the Automotive Innovation Fund (AIF) was scheduled to end in 2012–13; however, reprofiling of funds extended that date to 2014–15. Renewal of funding for the AIF was announced on . Funding for AIF will be reflected in future Estimates documents.

For further information, please consult the Analysis of Programs and Sub-Programs by Strategic Outcome section of this report.

Strategic Outcome: Canadian businesses and communities are competitive

The change in spending since 2010–11 for this Strategic Outcome is mainly due to the completion of activities related to stimulus funding from Canada's Economic Action Plan 2009.

Payments to lenders with respect to claims for losses on defaulted loans made under the Canada Small Business Financing Program (reported under Small Business Research, Advocacy and Services) have decreased significantly since 2010–11 as a result of the economic recovery. This trend is expected to continue over the coming years.

The changes in planned spending in future years under the Industrial Competitiveness and Capacity program are largely due to winding down the Structured Financing Facility Program, as the federal procurement of ships begins under the National Shipbuilding Procurement Strategy. The Program stopped taking proposals on . There are also changes resulting from the Department's implementation of measures announced in Budget 2011 and Budget 2012. Actual Spending for 2010–11 included the final contributions to the Marquee Tourism Events Program (Budget 2009).

The changes in spending for the Community Economic Development program are primarily due to the near completion of Broadband Canada: Connecting Rural Canadians (Budget 2009).

For further information, please consult the Analysis of Programs and Sub-Programs by Strategic Outcome section of this report.

Internal Services

The Department operates on a funding model whereby a portion of its core budget comes from repayment of contributions made under former industrial and research support programs. The repayments owed and collected have been declining over the years as recipients fulfill their repayment obligations, having a direct impact on the amount that the Department is allowed to spend. While this portion of the operating budget supports activities across the Department, it is all recorded against Internal Services to streamline administration.

Every year, the Department is entitled to access deferred funding from the previous fiscal year to reinvest in departmental priorities, such as information technology. That deferred funding is not included in the planned spending as the amount is established later in the fiscal year.

For further information, please consult the Analysis of Programs and Sub-Programs by Strategic Outcome section of this report.

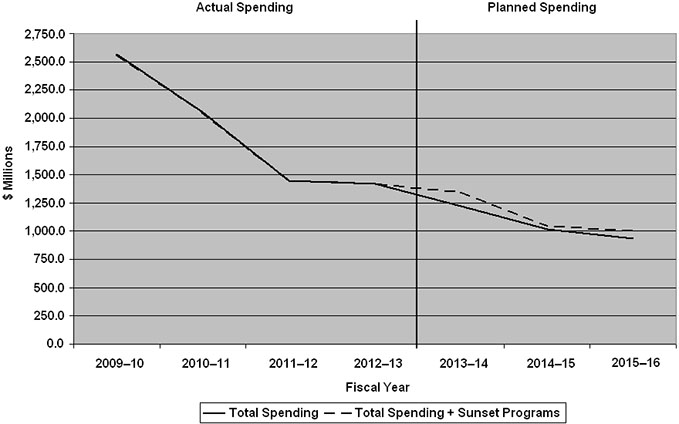

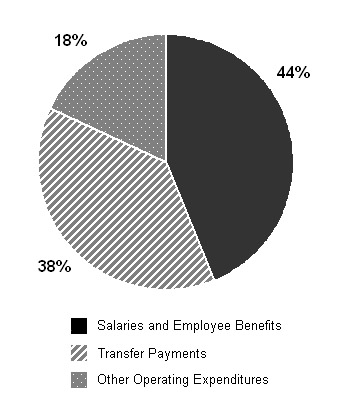

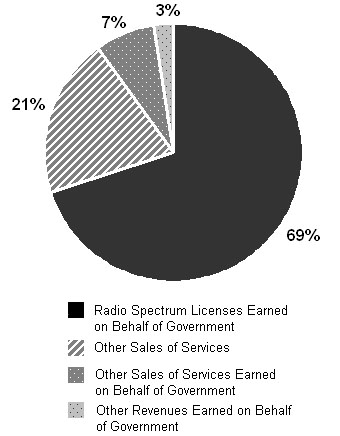

Expenditure Profile

Departmental Spending Trend ($ millions)

Departmental Human Resource Trend (Full-Time Equivalents – FTEs)

Expenditure Profile Explanation

The change in spending between 2009 and 2012 is primarily due to the completion of stimulus funding from Canada's Economic Action Plan 2009. Changes in planned spending are due to:

- grants and contributions programs for which current funding ends in 2013–14 or 2014–15;

- the Department's implementation of measures announced in Budget 2011 and in Budget 2012.

In Budget 2012, the Government announced plans to reduce the federal deficit and return to fiscal balance over the medium term. In response, long-term financial affordability and a commitment to ensuring the Department is able to continue to deliver its mandate and its core activities have been a key focus of all financial decisions.

As a result, Industry Canada's savings are centered on three main areas, and do not affect direct services to Canadians:

- reducing administrative expenditures by improving efficiencies;

- reducing expenditures by consolidating program and office functions; and

- refocusing and realizing efficiencies in research and analysis functions while maintaining adequate capacity for targeted policy development.

In 2012–13, the Department achieved savings of $49.2 million. These savings increase to $65.2 million for 2013–14 and will result in ongoing savings of $79.5 million by 2014–15. The savings will largely come from changes in the amount of repayable contributions that the Department accesses through Supplementary Estimates. Details regarding ongoing savings are available in the supplementary data on Budget 2012 implementation.

In response to changes announced in Budget 2011 and in Budget 2012, Industry Canada has carefully managed all staffing decisions, including controls on those in revenue generating organizations. The Department began implementing these changes up-front in 2012–13. The strategic decision was made to identify all affected employees in the first year so that they would be well positioned to find jobs before the market became saturated. This measure resulted in lower-than-planned full-time equivalent (FTE) use.

For additional information related to the departmental spending presented above, see the Analysis of Programs and Sub-Programs by Strategic Outcome section.

Estimates by Vote

For information on Industry Canada's organizational Votes and statutory expenditures, please see the Public Accounts of Canada 2013 (Volume II). An electronic version of the Public Accounts 2013 is available on the Public Works and Government Services Canada website.

Contribution to the Federal Sustainable Development Strategy

The Federal Sustainable Development Strategy (FSDS) outlines the Government of Canada's commitment to improving the transparency of environmental decision making by articulating its key strategic environmental goals and targets.

Industry Canada ensures that consideration of these outcomes is an integral part of its decision-making processes. Industry Canada contributes to two of the four FSDS themes as denoted by the visual identifiers and associated Programs below. These symbols can be found throughout the report and identify areas where efforts are contributing to the FSDS.

|

Theme I: Addressing Climate Change and Air Quality |

|

Theme IV: Shrinking the Environmental Footprint—Beginning with Government |

Industry Canada's contributions to the FSDS are components of the following programs and are further explained under Analysis of Programs and Sub-Programs by Strategic Outcome:

![]() Science, Technology and Innovation Capacity

Science, Technology and Innovation Capacity

![]() Industrial Research and Development Financing

Industrial Research and Development Financing

![]() Industrial Competitiveness and Capacity

Industrial Competitiveness and Capacity

![]() Community Economic Development

Community Economic Development

During 2012–13, Industry Canada updated its Strategic Environmental Assessment (SEA) guide and strengthened its management accountability system. The Department's SEA complies with the 2010 Cabinet Directive on the Environmental Assessment of Policy, Plan and Program Proposals, which requires that departments consider how policy, plan or program proposals support the goals and targets of the Federal Sustainable Development Strategy. In 2012–13, the Department conducted 42 preliminary scan SEAs.

For more information on Industry Canada's activities to support sustainable development, and on the results of SEAs and Industry Canada's SEA process, please consult the Industry Canada website.

For further information on the Federal Sustainable Development Strategy, please consult the Environment Canada website.

Analysis of Programs and Sub-Programs by Strategic Outcome

- Strategic Outcome: The Canadian marketplace is efficient and competitive

- Strategic Outcome: Advancements in science and technology, knowledge, and innovation strengthen the Canadian economy

- Strategic Outcome: Canadian businesses and communities are competitive

- Internal Services

Analysis of Programs and Sub-Programs by Strategic Outcome (continued)

Strategic Outcome: The Canadian marketplace is efficient and competitive

Industry Canada fosters competitiveness by developing and administering economic framework policies that promote competition and innovation, support investment and entrepreneurial activity, and instil consumer, investor and business confidence. Progress towards achieving this outcome was accomplished in 2012–13 through the following programs and sub-programs:

- Program: Marketplace Frameworks and Regulations

- Sub-Program: Trade Measurement

- Sub-Program: Bankruptcy and Insolvency

- Sub-Program: Federal Incorporations

- Sub-Program: Investment Review

- Sub-Program: Intellectual Property

- Sub-Program: Internal Trade Secretariat

- Program: Spectrum, Telecommunications and the Online Economy

- Sub-Program: Spectrum Management and Telecommunications

- Sub-Program: Electronic Commerce

- Program: Consumer Affairs

- Program: Competition Law Enforcement

Program – Marketplace Frameworks and Regulations

Description

Industry Canada is responsible for the oversight and regulation of a number of aspects of the Canadian marketplace, including bankruptcy, foreign direct investment, federal incorporation, intellectual property and trade measurement. To deliver on its mandate, Industry Canada, through this Program, administers framework statutes, regulations, policies and procedures; develops, sets, and assures compliance with standards; performs reviews; and holds meetings with a variety of stakeholders. Overall, the Program benefits Canadians by ensuring the integrity of the marketplace.

| Total Budgetary Expenditures (Main Estimates) 2012–13 |

Planned Spending 2012–13 |

Total Authorities (available for use) 2012–13 |

Actual Spending (authorities used) 2012–13 |

Difference 2012–13 |

|---|---|---|---|---|

| 52.3 | 49.6 | 206.7 | 30.3 | 19.3 |

|

Planned 2012–13 |

Actual 2012–13 |

Difference 2012–13 |

|---|---|---|

| 1,836 | 1,685 | 151 |

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Regulatory time frames and service standards are met | Average percentage of regulatory timeframes or service standards met | 80% | 97.6% |

| Canadian marketplace frameworks and regulations are effective by international standards | Canada's rank among G7 nations in effectiveness of marketplace frameworks and regulations for starting a business, impact of rules on foreign investment, and intellectual property | 1st | 2nd |

Performance Analysis and Lessons Learned – Marketplace Frameworks and Regulations

Industry Canada continued to focus on improving efficiency and competitiveness in the marketplace by modernizing administrative processes and undertaking legislative and regulatory initiatives.

In 2012–13, Industry Canada met or exceeded service standards or regulatory timeframes an average of 97.6 percent of the time across the five areas in this Program, an improvement compared to 2011–12 (95 percent).

Canada's overall second place score for the effectiveness of its marketplace frameworks and regulations is based on an average of its rankings on three OECD and World Bank indicators, and remains unchanged from 2011–12. In 2012–13, Canada ranked 1st on the Starting a Business indicator, 2nd on the Business Impact of Rules on the foreign direct investment (FDI) indicator, and 3rd on the Intellectual Property Protection indicator.

As anticipated in the 2012–13 Report on Plans and Priorities, Industry Canada continued its work to implement the Fairness at the Pumps Act, making significant progress on the development of proposed regulations necessary to implement mandatory measuring device inspection frequencies and administrative monetary penalties under the Electricity and Gas Inspection Act and the Weights and Measures Act.

Fiscal year 2012–13 also saw changes to the Investment Review framework, including the Investment Canada Act.

The Total Authorities figure for this program includes Canadian Intellectual Property Office's (CIPO) unused authority of $163.1 million, which takes into account the operating surpluses that CIPO, an organization within the Department that is funded entirely from the revenues it generates, has accumulated in its revolving fund since its creation in 1994, as well as amounts deposited in the Consolidated Revenue Fund (CRF), which the organization requires to finance its balance sheet activities (i.e., deferred revenues). The intent is never to spend the accumulated surplus portion in a single year but to draw on it as required to fund capital investments or when expenses exceed revenues.

The difference between Planned and Actual Spending under Marketplace Frameworks and Regulations is partly the result of net income from operations generated by CIPO being higher than expected. For further information, please refer to the sub-program section below.

Sub-Program – Trade Measurement

Description

Measurement Canada, a special operating agency, ensures the integrity and accuracy of goods and services bought and sold on the basis of measurement in Canada. It protects Canadians against financial loss due to inaccurate measurement and maintains consumer and business confidence in measurement-based financial transactions (trade measurement) by ensuring that devices (e.g., scales, gas pumps, and electricity and natural gas meters) used in Canada meet legislative standards for accuracy and performance. Measurement Canada investigates measurement practices in the Canadian marketplace and compels institutions to take corrective actions when unfair practices are found.

| Planned Spending 2012–13 |

Actual Spending 2012–13 |

Difference 2012–13 |

|---|---|---|

| 29.8 | 29.8 | – |

| Planned 2012–13 |

Actual 2012–13 |

Difference 2012–13 |

|---|---|---|

| 353 | 275 | 78 |

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Accurate trade measurement in Canada | Percentage of marketplace monitoring inspections where devices are found to be measuring accurately | 80% | 88% |

| Percentage of Measurement Canada product and surveillance audits which confirm authorized service providers' competencies to conduct inspections on the agency's behalf | 90% | 97% |

Performance Analysis and Lessons Learned – Trade Measurement

Industry Canada, through Measurement Canada, exceeded the performance targets for both indicators, by eight and seven percent, respectively.

Overall, 88 percent of the devices inspected through a marketplace monitoring program were in compliance with the rules on accuracy. This result is unchanged from 2011–12. However, improvements were seen in some sectors, including the forestry, mining, livestock and poultry, dairy, and food and beverage manufacturing sectors.

Industry Canada actively monitored the competency of the authorized service providers and recognized technicians who perform inspections on Measurement Canada's behalf, finding that 97 percent of those audited are performing inspections and applying legislative requirements correctly. This improvement over the previous year may be attributed to enhancements to Measurement Canada business processes and a strong commitment to oversight.

The difference between Planned and Actual FTEs reflects difficulties in finding candidates, as well as internal reallocations made during the year to better align human resources with the Department's strategic outcomes and programs.

Sub-Program – Bankruptcy and Insolvency

Description

For the benefit of investors, lenders and consumers and in the public interest, the Office of the Superintendent of Bankruptcy supervises the administration of estates and matters under the Bankruptcy and Insolvency Act and the Companies' Creditors Arrangement Act. It provides leadership in protecting the integrity of the bankruptcy and insolvency system by maintaining an efficient and effective insolvency regulatory framework; promoting awareness of the rights and responsibilities of the stakeholders; ensuring trustee and debtor compliance with the legislative and regulatory framework through the supervision of debtors and of trustees administering estates; and being an integral source of information on Canadian insolvency matters.

| Planned Spending Footnote 1 2012–13 |

Actual Spending Footnote 2 2012–13 |

Difference 2012–13 |

|---|---|---|

Footnotes

| ||

| 5.7 | 6.9 | (1.2) |

| Planned 2012–13 |

Actual 2012–13 |

Difference 2012–13 |

|---|---|---|

| 368 | 372 | (4) |

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Estates are supervised and administered in accordance with insolvency legislation | Percentage of trustees with a satisfactory compliance rating: A or B on a range of A–D | 85% | 93% |

| Percentage of debtors with surplus income who completed payments to the estate as required | 75% | 91% |

Performance Analysis and Lessons Learned – Bankruptcy and Insolvency

Industry Canada, through the Office of the Superintendent of Bankruptcy (OSB), exceeded the performance targets for both indicators by eight and sixteen percent, respectively.

As in 2011–12, satisfactory compliance was achieved by 93 percent of trustees at the end of 2012–13, confirming that they comply with the bankruptcy and insolvency regulatory framework. This high level of compliance contributes to public confidence in the Canadian insolvency system.

Required payments to the estate were made by 91 percent of debtors who had surplus income in 2012–13, an increase of nine percent over the previous year. Successful mediation sessions conducted by the OSB contributed to this increase. Surplus income paid by debtors results in payments to creditors and contributes to maintaining public confidence in the integrity of the insolvency system.

An evaluation of the OSB mandatory counselling program was completed in 2012–13. It found that mandatory counselling addresses a continued need by contributing to the rehabilitation of debtors and helping them avoid future financial difficulties. Debtors found the counselling sessions useful and, following these sessions, were generally more aware of sound financial practices and changed their behaviour. Evidence suggests that debtors who cited the overuse of credit as a reason for their financial difficulties were less likely to be repeat filers after counselling. The evaluation recommended developing and collecting additional data to further measure the effectiveness of mandatory counselling, examining the current model of mandatory counselling to see if options could be provided to better address the needs of the various debtor groups, and exploring ways of facilitating access to tools and products for delivery of the program. For more information on the evaluation and the management response and action plan, please refer to the report available on the Industry Canada website.

The Office of the Superintendent of Bankruptcy (OSB) is a revenue generating program. The information reflected in the financial resources table above is net of revenue, and represents mainly the employee benefit plan (EBP) costs associated with this program.The Actual spending on EBP can vary from the planned spending as a result of a different utilization of the plan by employees than originally estimated by Treasury Board Secretariat.

Sub-Program – Federal Incorporations

Description

This Program allows Canadians and businesses to incorporate at the federal level in accordance with Canada's laws, such as the Canada Business Corporations Act, the Canada Corporations Act, the Boards of Trade Act and the Canada Cooperatives Act (with the exception of financial institutions). It also issues and registers official documents under the Great Seal of Canada. The Program's main lines of business include incorporation and related services (such as amalgamation or corporate charter amendments), the dissolution of corporations, rulings on the use of corporate names, the collection and dissemination of information on federal companies, and compliance and enforcement activities related to the statutes it administers. The Program's activities mostly affect Canadian businesses, not-for-profit organizations and other corporate entities.

| Planned Spending Footnote 3 2012–13 |

Actual Spending Footnote 4 2012–13 |

Difference 2012–13 |

|---|---|---|

Footnotes

| ||

| 1.4 | 2.0 | (0.6) |

| Planned 2012–13 |

Actual 2012–13 |

Difference 2012–13 |

|---|---|---|

| 74 | 84 | (10) |

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Federally incorporated companies are compliant with corporate laws and regulations | Percentage of federally incorporated corporations that comply with statutory filing requirements | 80% | 89% |

| Businesses have timely access to incorporations and information services | Percentage of published Corporations Canada service standards that are met or exceeded | 90% | 97% |

| Corporations Canada key services are available/delivered to businesses electronically | Percentage of transactions for key services completed online | 80% | 98% certificates 94% annual returns |

Performance Analysis and Lessons Learned – Federal Incorporations

In 2012-13, 89 percent of federal corporations complied with annual filing requirements, an increase of five percentage points over 2011–12. The improvement in performance correlates with the implementation of an improved reminder process, built into Corporations Canada's information technology system.

Published service standards were met or exceeded 97 percent of the time, which amounts to an increase of one percent over 2011–12.

Online services provide access to faster service and lower fees for businesses seeking incorporation and filing annual returns. The percentage of transactions completed online improved in 2012–13: 98 percent of certificates of incorporation and 94 percent of annual returns were completed online, exceeding the target. This is an increase of 0.8 percent and 1.3 percent, respectively, over 2011–12, reflecting the business and legal communities' continued increased use of online tools over the years. In 2012–13, the Department began to develop online services that will allow federal not-for-profit corporations to incorporate, file annual returns and update their corporate information online. As a first step, online filing of annual not-for-profit corporate returns was launched in January 2013.

As was planned in the 2012–13 RPP, in March 2013, Industry Canada launched improvements to the self-serve online company name search system, Newly Updated Automated Name Search (NUANS). These improvements will enable more corporate law regulators to implement a self-serve option for their clients. As a result, the Government of the Northwest Territories adopted the system, bringing the number of jurisdictions using this joint administrative tool to 10.

Industry Canada completed an evaluation of Corporations Canada in 2013, which confirmed that the organization operates with low barriers to business, ensures compliance with legislation, and provides for strong corporate governance in support of entrepreneurship. The evaluation recommended expanding online and e-filing services. For more information on the evaluation and the management response and action plan, please refer to the report available on the Industry Canada website.

Federal Incorporations is a vote net revenue program, i.e., it has a special revenue spending authority from Parliament which allows the department to use revenue from the sale of products or services to finance directly related expenditures. The information reflected in the financial resources table above is net of revenue, and represents mainly the employee benefit plan (EBP) costs associated with this program. The Actual spending on EBP can vary from the planned spending as a result of a different utilization of the plan by employees than originally estimated. For more information on revenues, refer to the Respendable Revenue table.

Additional funding was received in Supplementary Estimates for royalties collected for the NUANS system, which provides a one-stop name search service to the Canadian business community.

The difference between Planned and Actual FTEs mainly reflects internal reallocations made during the year to better align human resources with the Department's strategic outcomes and programs.

Sub-Program – Investment Review

Description

The purpose of the Investment Canada Act is to provide for the review of significant investments in Canada by non-Canadians in a manner that encourages investment, economic growth and employment opportunities in Canada and to provide for the review of investments in Canada by non-Canadians that could be injurious to national security. This Program implements the provisions of the Act by ensuring that the Minister of Industry has the information needed to determine whether an investment is likely to be of net benefit to Canada or whether there are reasonable grounds to believe that an investment could be injurious to national security. This is accomplished by processing notifications filed by investors and completing reviews of transactions under the Act.

| Planned Spending 2012–13 |

Actual Spending 2012–13 |

Difference 2012–13 |

|---|---|---|

| 1.2 | 1.7 | (0.5) |

| Planned 2012–13 |

Actual 2012–13 |

Difference 2012–13 |

|---|---|---|

| 10 | 12 | (2) |

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Timely processing of foreign investment notifications and applications for review filed by foreign investors under the Investment Canada Act | Median time required to certify notifications | 5 days | 3 days |

| Median time required to process applications | 70 days | 70 days |

Performance Analysis and Lessons Learned – Investment Review

Industry Canada certified as complete 664 notifications of foreign investments for acquisitions below the regulatory thresholds for review or for the establishment of new businesses, improving the median time required from five days in 2011–12 to three days in 2012–13. For investments above the thresholds, 18 applications for review were processed and approved by the Minister of Industry. A median time of 70 days was achieved in 2012–13. This constitutes an improvement from the previous year's result of 74 days, despite the larger, more complex investment transactions under review.

In 2012–13, several changes were made to the Investment Canada Act and the investment review framework. In particular, in December 2012, the Government clarified the assessment process for investments by state-owned enterprises (SOE), revised the guidelines for SOEs, and announced its intention to retain the current net benefit review threshold for World Trade Organization (WTO) SOE investors, while maintaining plans to progressively increase the threshold for other WTO investors to $1 billion in enterprise value.

Legislative changes passed in 2009 progressively raise the review threshold for WTO investors or vendors (other than Canadians) to $1 billion over a four-year period, and change the basis of the threshold from asset value to enterprise value. The regulations related to the threshold were published for comment in the Canada Gazette Part I, Vol. 146, No. 22 on .

In addition, changes were made earlier in the year which provide the Minister of Industry with a greater ability to publish information on the review process, while preserving commercial confidences. The amendments also promote investor compliance with undertakings by authorizing the Minister to accept security, when offered by an investor, for payment of any penalties ordered by a court for a contravention of the Investment Canada Act. Formal mediation procedures were introduced in the Act in May, as an alternative to litigation.

The difference between Planned and Actual FTEs mainly reflects the increase in workload for 2012–13.

Sub-Program – Intellectual Property

Description

This Program administers Canada's system of intellectual property (IP) rights, namely patents, trademarks, copyrights, industrial designs and integrated circuit topographies. The Canadian Intellectual Property Office (CIPO) grants and registers IP rights, legally recognizing certain endeavours of originality and creativity. It also disseminates information related to these rights to businesses, educational institutions and Canadians. CIPO's role is to ensure that IP contributes to an acceleration of Canadian economic development and that the benefits of the IP system accrue to Canadians. This program is entirely financed through a revolving fund and is fully cost recovered from client fees. Its clients include foreign and Canadian applicants for IP protection, users of IP information and the Canadian business community.

| Planned Spending Footnote 5 2012–13 |

Actual Spending Footnote 6 2012–13 |

Difference 2012–13 |

|---|---|---|

Footnotes

|

||

| 10.9 | (10.4) | 21.3 |

| Planned 2012–13 |

Actual 2012–13 |

Difference 2012–13 |

|---|---|---|

| 1,031 | 942 | 89 |

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

Footnotes

| |||

| Timely administration of intellectual property rights | Average number of days taken from first submission date to completion date of intellectual property files Footnote 7 | Industrial Design Files: 410 days |

Industrial Design Files: 292 days |

| Patent Files: 1,530 days |

Patent Files: 1,390 days |

||

| Trade-mark: 825 days |

Trade-mark: 824 days |

||

| Use of intellectual property by Canadians Footnote 8 | Number of domestic Canadian Intellectual Property filings | 25,530 | 26,881 |

| Number of international Canadian Intellectual Property filings | 27,890 | 33,699 | |

Performance Analysis and Lessons Learned – Intellectual Property

CIPO met or exceeded each of its performance targets for the administration of intellectual property rights in Canada in 2012–13. This improved performance is attributable to successful recruitment efforts and a continued commitment to lower turnaround times.

There were 26,881 domestic intellectual property filings in 2011Footnote 8 (4,754 patent filings, 21,337 trade-mark filings, and 790 industrial design filings), a 4.0 percent increase over 2010.

There were 33,699 international Canadian intellectual property filings in 2011Footnote 8 (19,518 patent filings, 12,781 trade-mark filings, and 1,400 industrial design filings), 6.3 percent higher than the number filed in 2010.

As was stated in the 2012–13 Report on Plans and Priorities, the Copyright Modernization Act received Royal Assent in June 2012. Among other things, the amended Act provides Canadian copyright owners with updated rights and protections to better address the challenges and opportunities of the Internet in line with international standards, and mandates a parliamentary review of the Copyright Act every five years. In October 2012, the Minister of Industry announced that certain sections and subsections would come into force on the day on which the World Intellectual Property Organization (WIPO) Copyright Treaty, or the WIPO Performances and Phonograms Treaty, come into force for Canada. Implementation of other elements, including the notice and notice regime, remained to be determined at year end.

In November 2012, regulations were published that exempt microSD memory cards from levies under the private copying regime.

In March 2013, the Minister of Industry joined the Minister of Public Safety to introduce the Combating Counterfeit Products Act. This new legislation would protect Canadian consumers, Canadian manufacturers and retailers, as well as the Canadian economy, from the health and economic threats presented by counterfeit goods coming into Canada.

CIPO is a revenue generating organization with a revolving fund. The figures in the financial resources table above represent the net spending for CIPO, which is the difference between expenses and revenues. The negative figure for Actual Spending means that revenues exceeded expenses in 2012–13. For more information on revenues, refer to the Respendable Revenue table.

The difference between Planned and Actual Spending is the result of two main factors. Net income from operations generated by CIPO was $11.5 million higher than planned (revenues from operations were $149 million and the associated expenses were $137.5 million). In addition, the expected payout of the employee termination liability did not materialize, since expired collective agreements either remained unsigned or were signed too late for payouts to occur by March 31. This combination of factors led to a $21.3 million difference which will be added to CIPO's unused authority for use in future years. The difference between Planned and Actual FTEs arose due to attrition and because some planned staffing did not occur.

Sub-Program – Internal Trade Secretariat

Description

The Agreement on Internal Trade (AIT) is an intergovernmental trade agreement signed by Canadian First Ministers, that came into force in 1995. The purpose of the AIT is to reduce and eliminate, to the extent possible, barriers to the free movement of persons, goods, services and investment within Canada and to establish an open, efficient and stable domestic market. The Internal Trade Secretariat provides administrative and operational support to the Committee on Internal Trade, to its Chair and to other committees or working groups established under the AIT or by the committee. It works closely with government officials to ensure the effective implementation of the AIT. The Secretariat supports the Committee on Internal Trade in preparing the reports, compiling and disseminating information from parties and ensuring appropriate support for the dispute resolution process. As a neutral third party, the Secretariat has facilitated ongoing negotiations to broaden and deepen the scope of the AIT. The work requires close and continuous contact with federal, provincial and territorial governments to facilitate the smooth and effective operation of the committees and working groups. The Secretariat plays an important role in assisting parties to fully implement the AIT, to pursue negotiations mandated by the AIT and to meet their outstanding obligations under the AIT. All parties share the Secretariat's operating costs. The federal government's share of the Secretariat's budget is 50 percent, which is paid by Industry Canada through a grant.

| Planned Spending 2012–13 |

Actual Spending 2012–13 |

Difference 2012–13 |

|---|---|---|

| 0.6 | 0.3 | 0.3 |

| Planned 2012–13 |

Actual 2012–13 |

Difference 2012–13 |

|---|---|---|

| – | – | – |

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| The Internal Trade Secretariat provides high-quality administrative support to the Committee on Internal Trade | Average score out of 10 of stakeholder satisfaction with the services provided by the Internal Trade Secretariat on federal stakeholder interviews | 8 out of 10 performance rating | This indicator was not evaluated in 2012-13. The previous result was 10 out of 10. |

Performance Analysis and Lessons Learned – Internal Trade Secretariat

The last evaluation of the Internal Trade Secretariat (ITS) was conducted in March 2011, and found that there is a continued need for the Secretariat.

The change in Actual Spending results from internal efficiencies achieved by the ITS.

Program – Spectrum, Telecommunications and the Online Economy

Description

This Program enables Canadians to benefit from a globally competitive digital economy that drives innovation, productivity and future prosperity. This includes developing and administering domestic regulations, procedures and standards that govern Canada's radiocommunication and telecommunications industries. The Program sets legislative and policy frameworks to encourage competition and private sector investment in world-class digital infrastructure, confidence in the online marketplace, and greater adoption of digital technologies by business. The Program maximizes the public benefits of spectrum by managing it efficiently and effectively, and promotes global telecommunications through the development of international treaties and agreements. International online trade and commerce is facilitated through participation in international bilateral and multilateral forums.

| Total Budgetary Expenditures (Main Estimates) 2012–13 |

Planned Spending 2012–13 |

Total Authorities (available for use) 2012–13 |

Actual Spending (authorities used) 2012–13 |

Difference 2012–13 |

|---|---|---|---|---|

| 85.5 | 88.7 | 127.1 | 126.2 | (37.5) |

| Planned 2012–13 |

Actual 2012–13 |

Difference 2012–13 |

|---|---|---|

| 673 | 657 | 16 |

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Canada's radiocommunication and telecommunications infrastructure and online economy are governed by an effective policy and regulatory framework | Percentage of Canadian radiocommunication and telecommunications objectives/proposals represented in international agreements, standards and negotiations at international forums | 90% | 90% |

| Percentage of Canadians buying and selling online | 43% Buying (All internet users at home) |

Data will be available for the 2013–14 DPR | |

| 15% Selling (All Canadians aged 16 and over) |

Data will be available for the 2013–14 DPR |

Performance Analysis and Lessons Learned – Spectrum, Telecommunications and the Online Economy

As indicated in the 2012–13 RPP, Industry Canada engaged in a number of consultations to ensure that the radiocommunication and telecommunication policy and regulatory framework remains effective. These consultations covered the E-Commerce Protection Regulations under Canada's anti-spam legislation; the use of parts of the D Block (700 MHz upper band) for public safety communications; the use of spectrum for backhaul (communication between a central core network and distributed base stations); and the policy for spectrum licence transfers, which will provide industry with greater clarity on how licence transfer requests are received. Industry Canada also published decisions regarding the use of spectrum white space for certain non-broadcasting purposes, and of the L Band for aeronautical mobile telemetry, used by Canada's aerospace industry for aircraft testing. The Department also revised the Framework for Mandatory Roaming and Antenna Tower and Site Sharing.

In an effort to help foster more competition in the telecommunications sector, particularly the wireless sector, Industry Canada continued its consultations on the format for upcoming spectrum auctions, publishing decisions for the 700 MHz—Mobile Broadband Services and 2500 MHz—Broadband Radio Service auctions.

On the international front, the Department completed negotiations on cross-border radio frequency sharing arrangements with the United States. As a result, Canadian licensees can use spectrum along the Canada-U.S. border without interference. Three Mutual Recognition Agreements (MRAs) were signed and/or ratified with Vietnam, Mexico, and Israel to facilitate the import and export of telecommunication products. Canadian manufacturers selling to these markets can have their products tested and certified in Canada for the purpose of compliance with regulatory requirements of the importing country.

The Department also conducted market surveillance activities to ensure that telecommunication equipment entering the Canadian marketplace met Industry Canada's standards. Two hundred and twenty-eight audits were conducted, and 62 instances of non-compliance were addressed.

Industry Canada participated in negotiations on treaty revisions to the International Radio Regulations at the 2012 World Radiocommunciation Conference, where Canada's objectives concerning provisions for some satellite communications issues were met. The Department also participated in the 2012 World Conference on International Telecommunications to revise the International Telecommunications Regulations. While some Canadian objectives for this negotiation were met, Canada did not sign the Final Acts. Industry Canada will continue to engage domestic stakeholders from the private sector, technical community, academia and civil society, and international partners, to ensure that our telecommunication and Internet interests and priorities are properly advanced and protected.

The increases in Total Authorities and Actual Spending are related to one-time additional funding received in Supplementary Estimates for the payment of a settlement agreement under Spectrum Management and Telecommunications operations.

Actual Spending also includes in-year costs related to compensation adjustments and pay list requirements to meet legal obligations of the employer (e.g., parental leave).

Sub-Program – Spectrum Management and Telecommunications

Description

The goal of this Program is to ensure the orderly and secure evolution of Canada's radio spectrum and telecommunications infrastructure through the development of a coherent regulatory framework, promotion of competition, establishment of sufficient regulation, enforcement of domestic and international requirements, and negotiation and promotion of international standards and treaties. This provides Canadian industries with the favourable conditions they need to develop, introduce and market leading technologies and services. The radio spectrum is a finite resource and can accommodate only a limited number of simultaneous users. Management of the radio spectrum requires careful planning to maximize its value for public and private services. This is achieved through the development and implementation of operational policies, procedures, processes, technical standards and international treaties. The Program also provides for an assessed annual contribution to the International Telecommunication Union (ITU), in which Canada participates as a Member State. Canada participates in ITU meetings to influence the Union's direction and decision making in support of Canadian interests. Another goal of this Program, which has the lead role for emergency telecommunications in Canada, is to make telecommunications services accessible to Canadians and to ensure that the public derives maximum benefit from their use.

| Planned Spending 2012–13 |

Actual Spending 2012–13 |

Difference 2012–13 |

|---|---|---|

| 81.0 | 120.2 | (39.2) |

| Planned 2012–13 |

Actual 2012–13 |

Difference 2012–13 |

|---|---|---|

| 636 | 626 | 10 |

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Canadians have timely access to radio frequency spectrum | Percentage of licence applications completed within service standards | 90% | 96.5% |

| Percentage of radiocommunication interference investigations completed within service standards | 90% | 97% |

Performance Analysis and Lessons Learned – Spectrum Management and Telecommunications

In order to ensure that Canadians have timely access to radio frequency spectrum, Industry Canada continued work on the efficient management of this finite resource. The target for the percentage of licence applications completed within service standards was exceeded at 96.5 percent (31,105 applications), with an average processing time of 28 days. The percentage of radiocommunication interference investigations completed within service standards was 97 percent (619 investigations), with an average response time of 34.8 days.

The Spectrum Application Modernization—Commercial Software Implementation project will allow the Department to modernize its approach for the management of the telecommunication spectrum. As anticipated in the 2012–13 RPP, Industry Canada began replacing the legacy Spectrum Management IT System by approving the final design and establishing the contract for the new system, expected to be in place in November 2013. The new system will provide new ways of issuing and managing radiocommunication licences in real time.

In March 2012, Industry Canada proposed amendments to the Telecommunications Act to remove foreign ownership restrictions on Canadian telecommunications service providers that hold less than a 10 percent share of the total Canadian telecommunications market based on revenue. Relaxing those rules will reduce investment barriers for smaller telecommunications companies and new entrants by allowing them to secure more foreign capital. The proposed amendments came into effect on .

The Department also developed and implemented rules for the upcoming auctions of the 700 MHz and 2500 MHz frequency bands. Auctioning these bands will support new mobile services in the Canadian marketplace, as well as promote sustained competition, robust investment and the availability of advanced wireless services for all Canadians, including those in rural areas.

In March 2013, the Commercial Mobile Spectrum Outlook was published, providing stakeholders with an overview of Industry Canada's overall approach and planned activities for spectrum over the next five years. With this publication, the Government of Canada is opening a new dialogue with spectrum users, licence holders and other stakeholders.

The increase in Actual Spending under this Sub-program is mainly related to one-time funding received in Supplementary Estimates for the payment of a settlement agreement.

Sub-Program – Electronic Commerce

Description

This Program strengthens Canadians' confidence in the marketplace by protecting individual privacy and curbing Internet threats. The successful integration of e-business into the Canadian economy is dependent on the level of trust and confidence businesses and consumers have in the digital environment. This Program clarifies marketplace rules through the development of legal and policy frameworks in the areas of privacy protection, online security and appropriate Internet content and removes barriers to the use of e-commerce in conjunction with the private sector. To improve market efficiency, the program promotes the conduct of e-business across all sectors of the economy and helps facilitate online trade and commerce internationally through the sharing of best practices and international benchmarking.

| Planned Spending 2012–13 |

Actual Spending 2012–13 |

Difference 2012–13 |

|---|---|---|

| 7.7 | 6.0 | 1.7 |

| Planned 2012–13 |

Actual 2012–13 |

Difference 2012–13 |

|---|---|---|

| 37 | 31 | 6 |

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Privacy and security of personal information and Internet-based trade and commerce are protected | Percentage of Canadian businesses that are aware of their responsibilities and compliance obligations under Canada's privacy laws | 65% | Data will be available for the 2013–14 DPR |

| Percentage of Canadians using the Internet | 86% | Data will be available for the 2013–14 DPR |

Performance Analysis and Lessons Learned – Electronic Commerce

The Canadian Businesses and Privacy-Related Issues survey is a biennial survey. As the next release is expected in March 2014, results information for this Sub-program is not available for this report. The Canadian Internet Use Survey 2012 results will be released in the fall of 2013. These indicators will be revised in the next reporting period.

As projected in the 2012–13 RPP, Industry Canada continued to strengthen Canadians' confidence in the online marketplace by taking steps to protect individual privacy and curb online threats. The Department contributed to the cyber security of Canada's telecommunication infrastructure by continuing to collaborate with the relevant industries to increase security. In collaboration with telecommunications service providers, work on the development of cyber security best practices began.

Industry Canada also continued to implement measures in support of the digital economy, accelerate adoption of digital technologies, to promote trust and confidence in the online marketplace and to foster a globally competitive information and communications technology (ICT) sector based on a modern legislative framework, a robust digital infrastructure and a digitally skilled workforce. During 2012–13, Industry Canada managed a federal-provincial and territorial Broadband Working Group in response to the recognition of the need for a shared approach to broadband for Canadians. Further initiatives that support the ICT sector were announced in Budget 2012, such as continued support for Canada's ultra high-speed research network, CANARIE.

The change in Actual Spending is mainly related to the transfer of funds to the Canadian Radio-Television and Telecommunications Commission for hosting the Spam Reporting Centre.

Program – Consumer Affairs

Description

This Program gives consumers a voice in the development of government policies and enables them to be effective marketplace participants. It is part of the Department's consumer affairs role under the Department of Industry Act, which directs the Minister to promote the interests and protection of consumers. Through research and analysis on marketplace issues, the Program supports both policy development and the intergovernmental harmonization of consumer protection rules and measures. It contributes to effective consumer protection through collaboration with provincial and territorial consumer protection agencies under Chapter 8 of the Agreement on Internal Trade and with other governments through the Organisation for Economic Co-operation and Development's Consumer Policy Committee. Industry Canada, through this program, identifies important consumer issues and develops and disseminates consumer information and awareness tools. These consumer protection information products and tools are developed either by the program itself or in collaboration with other consumer protection agencies. Finally, the Program provides financial support to not-for-profit consumer and voluntary organizations through the Contributions Program for Non-profit Consumer and Voluntary Organizations. The purpose of this support is to encourage the organizations to reach financial self-sufficiency and to assist them in providing meaningful, evidence-based input to public policy in the consumer interest.

| Total Budgetary Expenditures (Main Estimates) 2012–13 |

Planned Spending 2012–13 |

Total Authorities (available for use) 2012–13 |

Actual Spending (authorities used) 2012–13 |

Difference 2012–13 |

|---|---|---|---|---|

| 4.6 | 4.5 | 4.8 | 4.6 | (0.1) |

| Planned 2012–13 |

Actual 2012–13 |

Difference 2012–13 |

|---|---|---|

| 22 | 20 | 2 |

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

| Policymakers are aware of consumer issues in the Canadian marketplace | Number of instances per year where consumer research and/or analysis contributes to consumer policy discussions | 3 | 4 |

| Number of instances per year where research and analysis performed by consumer organizations supported by the OCA's Contributions Program for Non-Profit Consumer and Voluntary Organizations contribute to policy discussions or media coverage | 12 | 14 | |

| Citizens are aware of consumer issues in the Canadian marketplace | Number of visitors accessing information products on websites managed by the Office of Consumer Affairs (OCA) | 1.65 million | 1.08 million |

Performance Analysis and Lessons Learned – Consumer Affairs

In 2012–13, consumer policy research and analysis contributed to policy discussions in four major instances. Joint analysis supported federal, provincial and territorial consumer agencies' discussions on improving analysis of consumer complaints data. Industry Canada research formed the starting point for a Workshop on growing a university-based consumer policy network. Industry Canada also conducted analysis that contributed to standards development both domestically and internationally, on issues ranging from enhancing consumer participation in standards development to guidelines for businesses dealing with vulnerable and disadvantaged consumers, regulatory compliance management systems, and cross-border trade in second-hand consumer goods.

Through the Consumer Measures Committee (CMC), Industry Canada also examined strategies to maximize the benefits that can be realized from the CMC Cooperative Enforcement Agreement on Consumer-Related Measures. A working group also began an examination of best practices in enforcing legislation pertaining to debt collection services.

There were 14 instances of research and analysis performed by consumer organizations supported by the Contributions Program for Non-Profit Consumer and Voluntary Organizations which contributed to policy discussions or media coverage, including references in legislative committees of the Parliament of Canada, in the Superior Court of Québec, in official consultative processes and in federal working groups.

In 2012–13, there were 1,078,272 visitors to the consumer information products on websites managed by Industry Canada. Factors contributing to the declining trend were changes to the corporate website and to the schedule for the introduction of anti-spam regulations.

Industry Canada developed two new online tools for Canadian consumers, a Rent or Buy a Home calculator and a Mobile Protection Toolbox. The latter helps build awareness of Canada's anti-spam legislation, as does a new infographic that identifies key warning signs of spam. The Canadian Consumer Handbook, which provides federal-provincial-territorial consumer information for Canadians, was updated with two new sections: Group Buying and Timeshares.

As also noted in the 2012–13 RPP, the Department continued active participation in the development of guidelines and standards on consumer e-commerce, including through the OECD Committee on Consumer Policy and the International Organization for Standardization (ISO).

Financial and human resources for this program were utilized as planned in 2012–13.

Program – Competition Law Enforcement

Description

The objectives of this Program are to maintain and encourage competition to achieve a number of objectives, including promoting the efficiency and adaptability of the Canadian economy and protecting competitive markets. This Program also promotes equitable opportunities for businesses to participate in the Canadian economy to provide consumers with competitive prices and product choices. The Competition Bureau, an independent law enforcement agency, is responsible for the administration and enforcement of the Competition Act, the Consumer Packaging and Labelling Act, the Textile Labelling Act and the Precious Metals Marking Act. It seeks to ensure that businesses and individuals conform with the legislation under its jurisdiction through negotiated settlements, consent agreements and, where appropriate, prosecuting anti-competitive conduct through litigated proceedings. It protects competitive markets by detecting, disrupting and deterring anti-competitive conduct. The Competition Bureau encourages reliance on market forces. It provides advice to government legislators and policy-makers and intervenes and/or makes representations before federal and provincial boards, commissions and tribunals to encourage competition as a means of achieving policy or regulatory objectives.

| Total Budgetary Expenditures (Main Estimates) 2012–13 |

Planned SpendingFootnote 9 2012–13 |

Total Authorities (available for use) 2012–13 |

Actual SpendingFootnote 10 (authorities used) 2012–13 |

Difference 2012–13 |

|---|---|---|---|---|

Footnotes

| ||||

| 47.5 | 47.1 | 50.8 | 49.7 | (2.6) |

| Planned 2012–13 |

Actual 2012–13 |

Difference 2012–13 |

|---|---|---|

| 431 | 370 | 61 |

| Expected Results | Performance Indicators | Targets | Actual Results |

|---|---|---|---|

Footnotes

| |||

| Reduction in anti-competitive behaviour | Estimated dollar savings per annum to consumers from Bureau actions that stop anti-competitive activity | 515 millionFootnote 11 | 130 million |

Performance Analysis and Lessons Learned – Competition Law Enforcement

As anticipated in the 2012–13 RPP, Industry Canada, through the Competition Bureau, continued to maintain and encourage competition, including promoting the efficiency and adaptability of the Canadian economy, and protecting competitive markets.

The ongoing investigation of the retail gasoline sector in the Province of Québec resulted in eight individuals and one company pleading or being found guilty in 2012–13 of fixing the price of gasoline at the pump in four local markets in Québec.

A Consent Agreement was reached addressing concerns regarding BCE Inc.'s proposed acquisition of Astral Media Inc. The agreement requires significant divestitures that will preserve choice for consumers and ensure continued and effective competition in the supply of English and French pay and specialty television programming services in Canada.

In December 2012, the Competition Bureau commenced legal proceedings against Direct Energy Marketing Limited and Reliance Comfort Limited Partnership, two companies that rent water heaters to residential customers in Ontario. Following an investigation, it was determined each company engaged in practices that intentionally suppress competition and restrict consumer choice.

Efforts continued to reduce false or misleading advertising in the marketplace, in particular electronic representations directed at Canadian consumers and businesses. For example, following a five-month investigation, legal proceedings against Bell, Rogers Communications Inc., TELUS Corporation and the Canadian Wireless Telecommunications Association commenced, for alleged misleading advertising that promotes costly "premium texting services". The Bureau is seeking full customer refunds and a total of $31 million in administrative monetary penalties.